What Is MetaTrader?

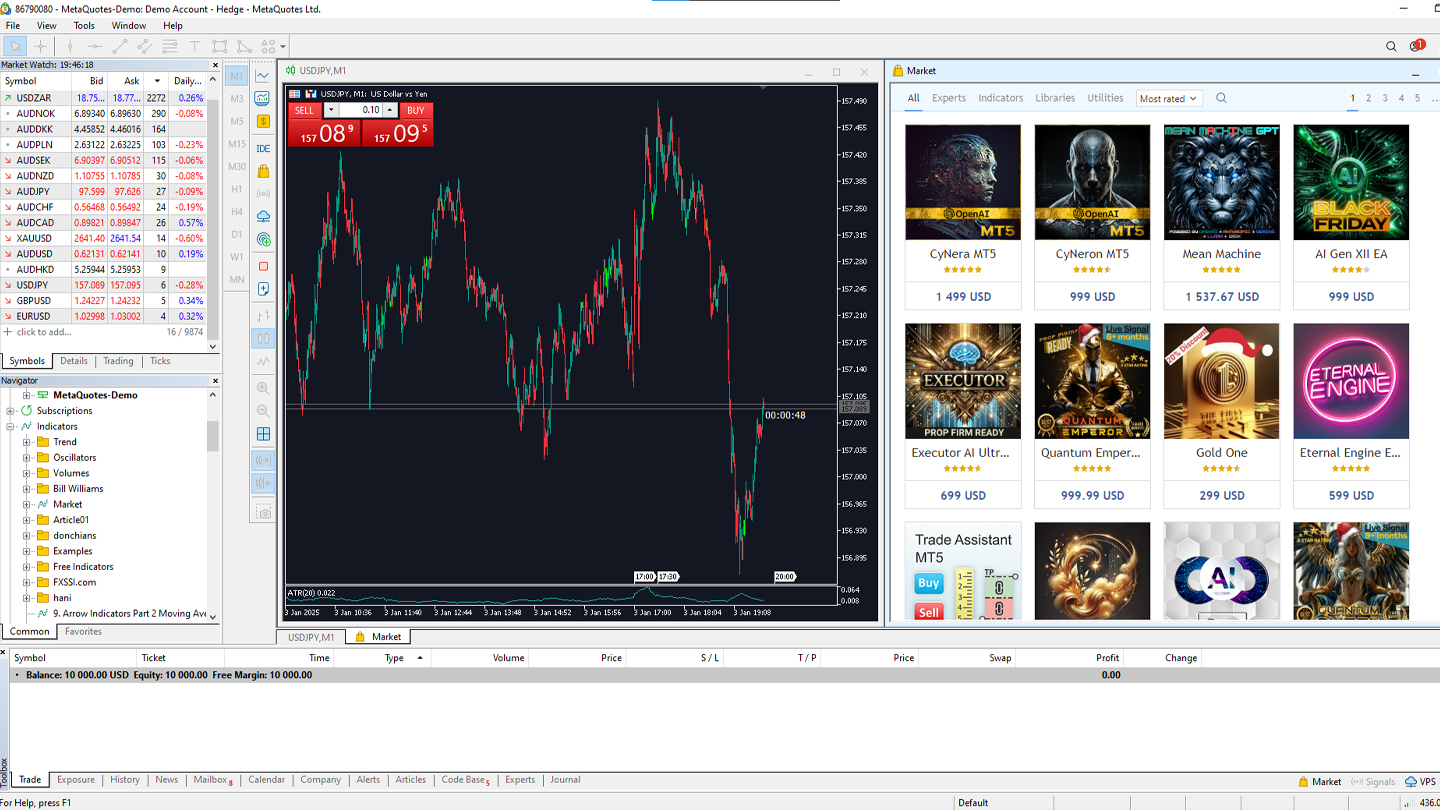

MetaTrader is a professional-grade electronic trading platform developed by MetaQuotes Software Corp. It allows traders to analyze markets, execute trades, and automate strategies.

There are two main versions:

- MetaTrader 4 (MT4): Primarily built for Forex, but supports CFDs and commodities.

- MetaTrader 5 (MT5): A multi-asset platform supporting Forex, stocks, commodities, futures, and cryptos (since the 2023 MetaQuotes update).

Both platforms offer:

- Advanced charting tools

- Technical indicators

- Automated trading (Expert Advisors)

⚠️ Note: As of January 2025, MT5 is now the preferred choice for brokers due to regulatory shifts in the EU and Asia requiring multi-asset platforms (source: ESMA 2025 report).

Why MetaTrader is Still Relevant in 2025

Since its launch in the early 2000s, MetaTrader has become one of the most widely used platforms for Forex, CFDs, commodities, and even stock trading. As of early 2025, over 50% of retail forex traders globally still use either MetaTrader 4 (MT4) or MetaTrader 5 (MT5), according to a report by Finance Magnates Intelligence (2025).

Its continued popularity stems from its powerful features, user-friendly interface, and extensive broker support.

In this guide, I’ll walk you through exactly how to use MetaTrader in 2025 with practical examples from my own 7 years of trading and 1 year as a CTO at a forex brokerage.

Key Features of MetaTrader

Here’s what makes MetaTrader powerful even in today’s fast-evolving market:

- Real-Time Charts

Monitor price action on multiple timeframes (from 1 minute to 1 month). - 60+ Built-in Technical Indicators

Includes Moving Average, RSI, MACD + thousands of custom indicators on the MetaTrader Market (verified by MetaQuotes). - Expert Advisors (EAs)

Automate trading strategies. Example: My EA that buys EUR/USD when RSI <30 saved me over 8 hours weekly in manual chart watching. - Multiple Order Types

Market, Limit, Stop, and Stop-Limit (MT5 exclusive). - Advanced Risk Management Tools

Integrated Trailing Stops and One-Click Trading.

How to Get Started with MetaTrader (Step-by-Step)

Follow these exact steps and you’ll be trading confidently within an hour:

1. Choose a Regulated Broker

- Check regulatory bodies like FCA (UK), ASIC (Australia), or CFTC (US).

- In 2025, top-rated MT5 brokers (source: ForexPeaceArmy 2025) are:

- IC Markets

- Pepperstone

- OANDA

2. Download & Install MetaTrader

- Go to your broker’s website and download MetaTrader 5 (desktop, mobile, or web).

- Follow installation prompts.

🖥️ Example: On Windows, it takes under 3 minutes.

3. Create a Trading Account

- Open a demo (practice) or live (real money) account.

- Login using your account number and password.

4. Fund Your Account (For Live Trading)

- Deposit funds securely via bank transfer, credit card, or e-wallet.

- Tip: Stick with brokers using segregated accounts for extra fund safety.

MetaTrader 4 vs MetaTrader 5

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

|---|---|---|

| Market Support | Forex, CFDs | Forex, Stocks, Commodities, Crypto |

| Timeframes | 9 | 21 |

| Programming Language | MQL4 | MQL5 (Faster & More Versatile) |

| Economic Calendar | No | Yes |

| Hedging & Netting | Hedging only | Hedging & Netting |

| Backtesting | Single-threaded | Multi-threaded & Cloud Optimized |

| Supported Brokers (2025) | ~35% | ~80% |

| Suitable For | Forex-focused | Multi-asset & Advanced Traders |

✅ My Recommendation: Start directly with MetaTrader 5 in 2025 to future-proof your trading.

How to Place a Trade in MetaTrader

Here’s how I place my first trade when testing a new strategy:

- Open Market Watch

- Right-click on your asset (EUR/USD, Gold, etc.).

- Select Chart Window.

- Analyze the Market

- Add indicators (e.g., RSI + Moving Average crossover).

- Look for trends and patterns.

- Open a Trade

- Click New Order or press F9.

- Select:

- Volume (Lot size) — Start small (e.g., 0.01 lot = ~$1,000).

- Order Type — Market/Limit/Stop.

- Click Buy or Sell.

- Manage Your Trade

- Set Stop Loss and Take Profit immediately.

- Use Trailing Stop to lock profits as price moves in your favor.

💡 Example: In Jan 2025, I used a 50-pip Trailing Stop on EUR/USD during ECB rate hike news—this secured a +1.2% return without constant monitoring.

Pro Tips to Use MetaTrader Effectively

- Customize Your Workspace

- Use dark charts, grid removal, and custom indicators for clarity.

- Practice in Demo Mode First

- Spend 20–30 trades in demo before going live.

- Use Expert Advisors Wisely

- Only run EAs from verified sources. Test them in Strategy Tester first.

- Secure Your Account

- Enable two-factor authentication (2FA) on your broker dashboard.

- Stay Updated

- Follow economic calendars inside MT5 and reliable news like Bloomberg or Investing.com.

Final Thoughts

MetaTrader remains a powerful, trusted platform for traders in 2025. Whether you’re trading Forex, commodities, or stocks, its tools can help you make smarter, faster decisions.

By following the step-by-step instructions in this guide and staying disciplined you’ll have the confidence to start your trading journey the right way.

✅ Pro Tip: Keep learning! Explore new strategies, indicators, and tools inside MetaTrader to sharpen your skills.

Pro Tip: Always keep learning by exploring new indicators, scripts, and trading strategies to improve your MetaTrader experience and potential profitability.

MetaTrader FAQ

Yes, MetaTrader is beginner-friendly with a simple interface and tons of free tutorials, making it easy to learn and grow.

You can start with as little as $10, depending on your broker, but $100–$500 is more practical for real trading.

No, MetaTrader supports forex, crypto, commodities, indices, and even stocks—depending on the broker.

Yes, MetaTrader is legal in most countries. Just make sure you’re trading with a regulated broker.

MetaTrader is better for placing trades and automation, while TradingView excels in charting and community tools.

If you want advanced charts and social features, TradingView shines. For stock-focused trading, platforms like Thinkorswim or NinjaTrader are great.

Yes, TradingView is a trusted platform used by millions globally. Just remember: it’s for analysis, not direct trading (unless linked to a broker).

The best platform depends on your style. MetaTrader for execution, TradingView for analysis, and cTrader for advanced tools.

Trades may fail to execute due to several reasons:

Insufficient funds or margin: Your account doesn’t have enough capital to open the trade.

Incorrect lot size: You’re trying to place an order that’s too large or too small for the broker’s limits.

Market closed: You’re placing trades outside of trading hours (e.g. weekends).

Order type issues: A pending order might not meet the price condition set.

✅ Tip: Check the “Journal” and “Experts” tabs in your terminal for error messages.

A “disconnected” message usually means MetaTrader can’t communicate with your broker’s server.

Steps to fix:

Check your internet: Reconnect to a stable network.

Switch servers: Go to File → Login to Trade Account and try a different server.

Update credentials: Make sure your login, password, and server name are correct.

Reinstall or update MetaTrader: Corrupt files can cause connection problems.

✅ Pro tip: Use a VPS for more stable trading if you face frequent disconnections.

If your Expert Advisor (EA) isn’t functioning, try this checklist:

AutoTrading is off: Make sure the AutoTrading button is enabled (green).

EA is not attached: Confirm the EA is added to the correct chart and timeframe.

Incorrect inputs or conditions: Your EA might be waiting for specific market conditions.

Trading not allowed: Check “Common” tab in EA settings and ensure trading is permitted.

Errors in code: Open the “Experts” and “Journal” tabs to spot errors or warnings.

✅ Fix faster: Use MetaEditor to debug or test your EA in Strategy Tester.

MetaTrader 4 (MT4) is a trading platform designed for Forex and CFD trading, developed by MetaQuotes. It offers real-time charts, technical indicators, and automated trading (Expert Advisors). As of 2025, it’s still popular for Forex traders, though MetaTrader 5 is now more widely supported for multi-asset trading.

Your minimum deposit depends on the broker, not the MT4 software.

In 2025, reputable brokers have minimum deposits ranging from $50 to $200.

Example: IC Markets minimum deposit is $200 (source: IC Markets 2025).

1. Login to your broker’s client portal (not inside MT4).

2. Choose Deposit and select your payment method (bank, card, e-wallet).

3. Once funded, login to MT4 and your balance will reflect automatically.

1. Go to your broker’s dashboard.

2. Select Withdraw, choose method, and enter the amount.

3. Withdrawals do not happen inside MT4—it’s processed by the broker.

⚠️ Tip: Withdrawals usually take 1–5 business days depending on method.

1. Open Market Watch and choose an asset.

2. Open a Chart Window and analyze using indicators.

3. Click New Order to place a trade.

4. Monitor and manage your trade in Terminal > Trade tab.

1. Download MT4 and open the platform.

2. Click File > Open an Account > Demo.

3. Enter details, choose virtual balance (usually $10,000), and start practicing risk-free.

Choose a regulated broker offering MT5.

Register and complete KYC (ID verification).

Fund your account, then login to MT5 with provided credentials.

Open MT4 > Insert > Indicators.

Select built-in indicator (like RSI or MACD).

For custom indicators: Copy .ex4 file into MQL4 > Indicators folder, then restart MT4.

Open MT5 > Insert > Indicators.

Select from built-in options or download from MetaTrader Market.

For custom indicators: Copy .ex5 file into MQL5 > Indicators folder, then restart MT5.

Click New Order or press F9.

Select symbol, lot size, and order type.

Click Buy or Sell to open the position.

Go to Terminal > Trade tab.

Right-click the open trade > Select Close Order.

Click Close to confirm and exit the trade.

Close and reopen MT4—updates apply automatically.

If issues persist, download the latest version from your broker’s site or MetaQuotes.

Go to your broker’s website or MetaQuotes official site.

Download the MT4 Windows installer.

Run setup and follow on-screen instructions.

Ensure your broker offers Indices CFDs.

In Market Watch, right-click > Symbols > Indices > Show.

Open chart > Analyze > Place trade like Forex.

Open Market Watch > Right-click currency pair > Chart Window.

Click New Order.

Set volume, Stop Loss, Take Profit, and execute trade.

Click File > Save As Picture to save as an image.

Or click Charts > Template > Save Template to save chart settings/layout.

Open MT4 > File > Open an Account.

Search broker’s server name (get from broker’s website).

Login with account credentials provided by the broker.

Yes MetaTrader remains one of the most reliable and powerful trading platforms in 2025.

Pros:

Free to use

Wide broker support

Advanced tools + Automation

Cons:

MT4 is Forex-focused; use MT5 for multi-assets.

✅ My 2025 verdict (as a pro trader): MetaTrader is excellent for both beginners and experienced traders especially if you choose a regulated broker and use risk management wisely.

We hope this guide helps you understand MetaTrader and kick-start your trading journey. Remember, trading involves risk, so practice responsible money management and continually educate yourself to stay ahead in the markets.

Ready to Start?

👉 Share this guide with fellow beginners or bookmark it to reference later.

👉 Next step: Download MetaTrader 5 from a regulated broker and open your first demo trade today!