- Why Use a Trend Following Strategy?

- Core Concepts: Understanding Market Trends

- Key Indicators for Trend Following

- Trend Following Styles: Find What Fits You

- Step-by-Step: How to Start Using Trend Following

- Real-Life Example: EUR/USD Trend Trade

- Pro Tips for Beginners

- Summary: Is Trend Following Right for You?

- ❓ Frequently Asked Questions (FAQ)

- Take the Next Step

If you’re new to forex trading, you’ve probably heard the phrase “the trend is your friend.” This isn’t just a catchy saying—it’s the foundation of one of the most powerful trading strategies used by professionals and beginners alike: Trend Following.

Trend Following Trading Strategy involves identifying the direction of the market (uptrend, downtrend, or sideways) and making trades that follow that direction. Instead of trying to predict where the market will go next, trend followers react to what’s already happening.

As a Financial Risk Manager and CTO at a forex broker, with over 7 years of experience in trading and 3 years in data science, I’ve seen how effective this strategy can be when used correctly—especially by beginners.

Best Forex Trading Strategies for Start Trading

Why Use a Trend Following Strategy?

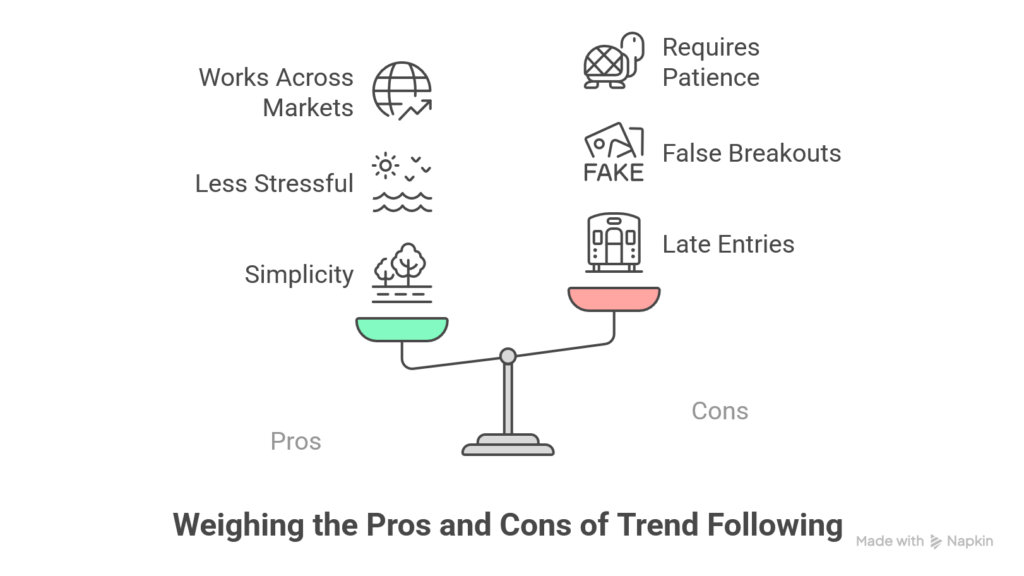

Pros:

- Simplicity – Easy to understand and implement.

- Less Stressful – Reduces emotional decision-making.

- Works Across Markets – Applicable in forex, stocks, and commodities.

- Builds Confidence – Encourages disciplined trading habits.

Cons:

- Late Entries – You may enter after the trend starts.

- False Breakouts – Not all trends are real.

- Requires Patience – Not ideal for traders who want quick results.

Core Concepts: Understanding Market Trends

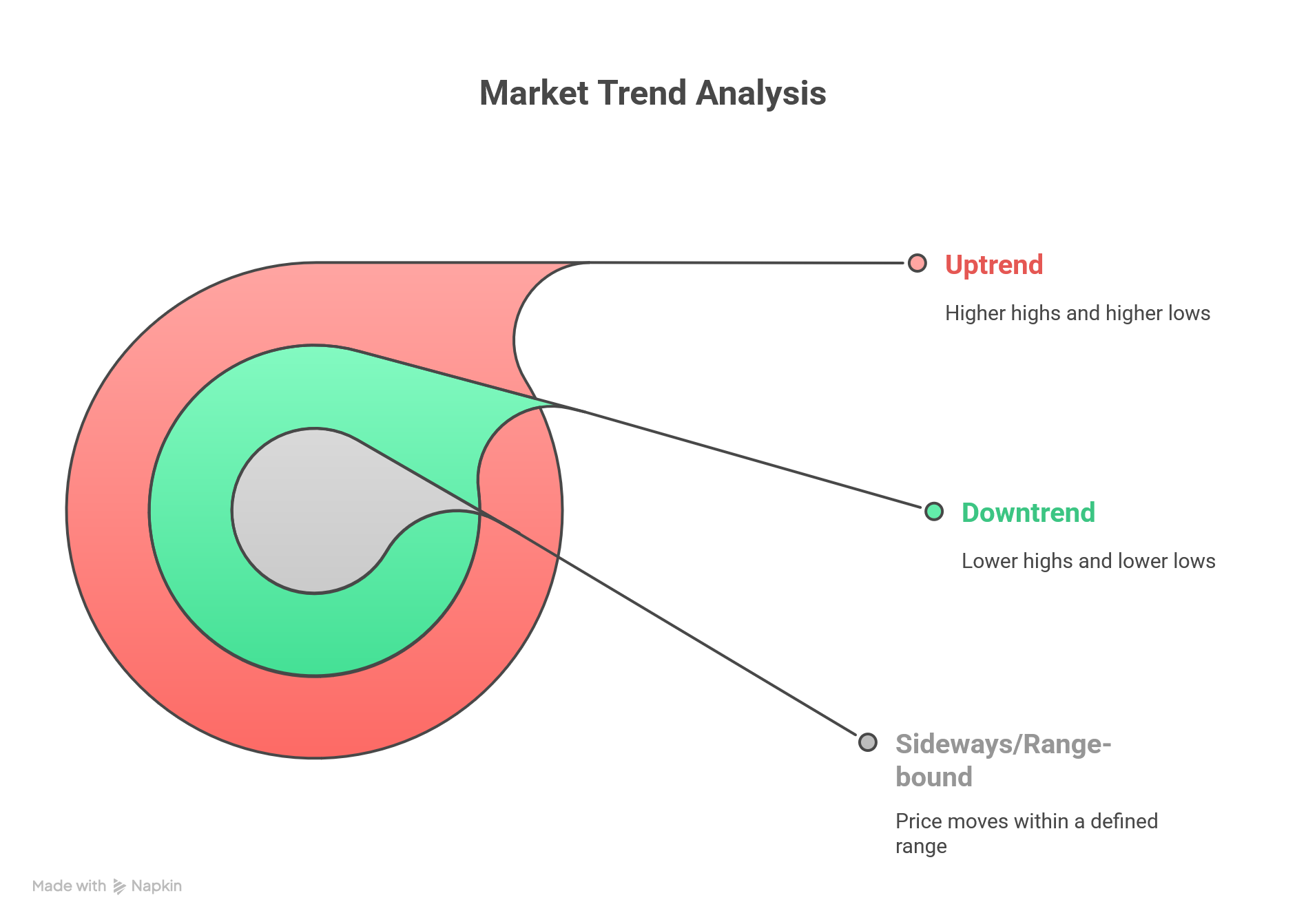

Before diving into strategies, it’s important to know the three types of trends:

- Uptrend – Higher highs and higher lows.

- Downtrend – Lower highs and lower lows.

- Sideways/Range-bound – Price moves within a defined range.

Trend followers focus only on uptrends and downtrends—the times when the market shows clear momentum in one direction.

Key Indicators for Trend Following

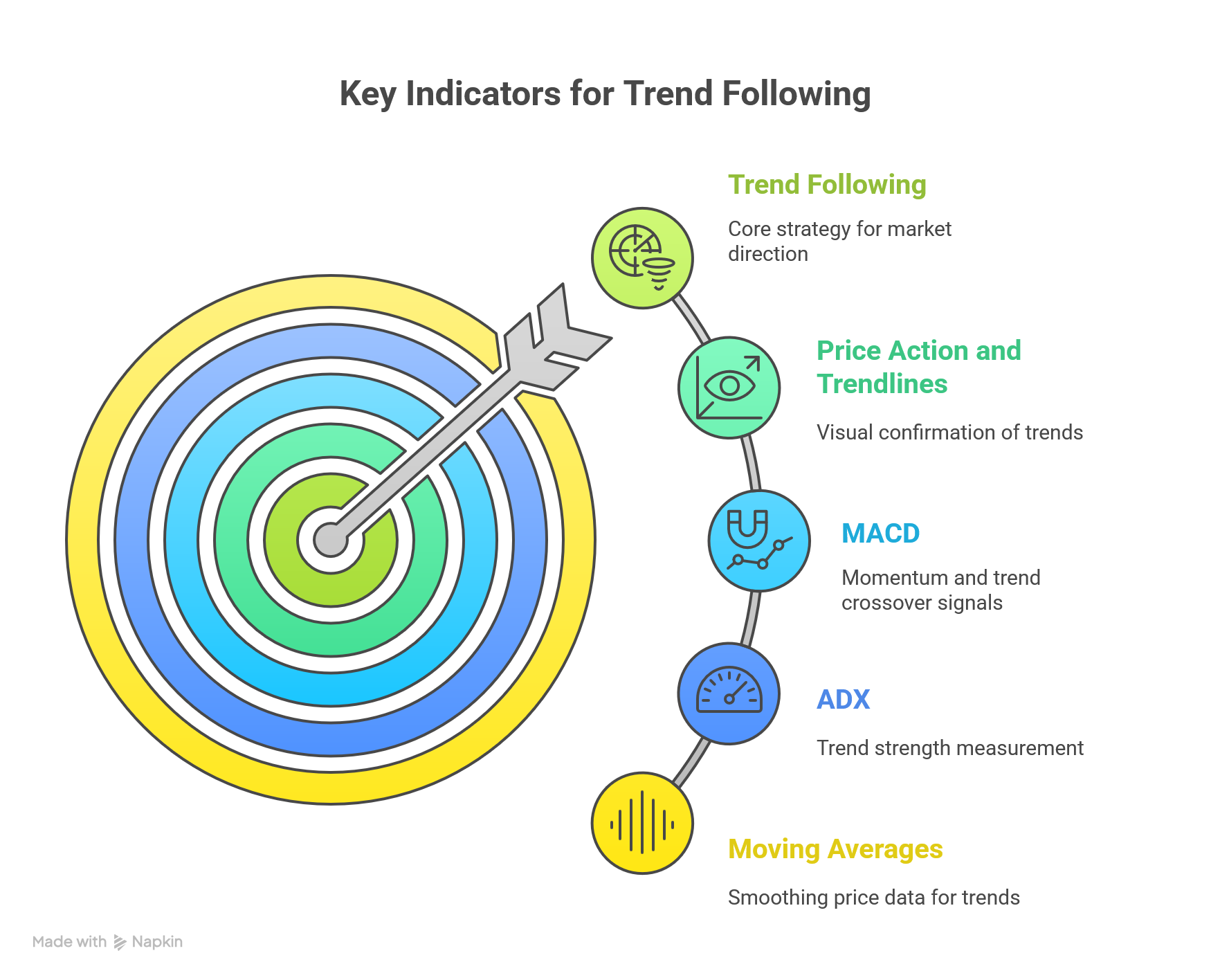

Here are the most commonly used tools to identify and follow trends:

1. Moving Averages (MAs)

- Simple Moving Average (SMA) and Exponential Moving Average (EMA) smooth out price data.

- Example: If the 50 EMA is above the 200 EMA, it signals an uptrend.

2. Average Directional Index (ADX)

- Measures the strength of a trend.

- Readings above 25 indicate a strong trend.

3. MACD (Moving Average Convergence Divergence)

- Combines trend and momentum signals.

- A bullish crossover = potential start of an uptrend.

4. Price Action and Trendlines

- Visual patterns like higher highs/lows or lower highs/lows.

- Draw trendlines to confirm visual trends.

Trend Following Styles: Find What Fits You

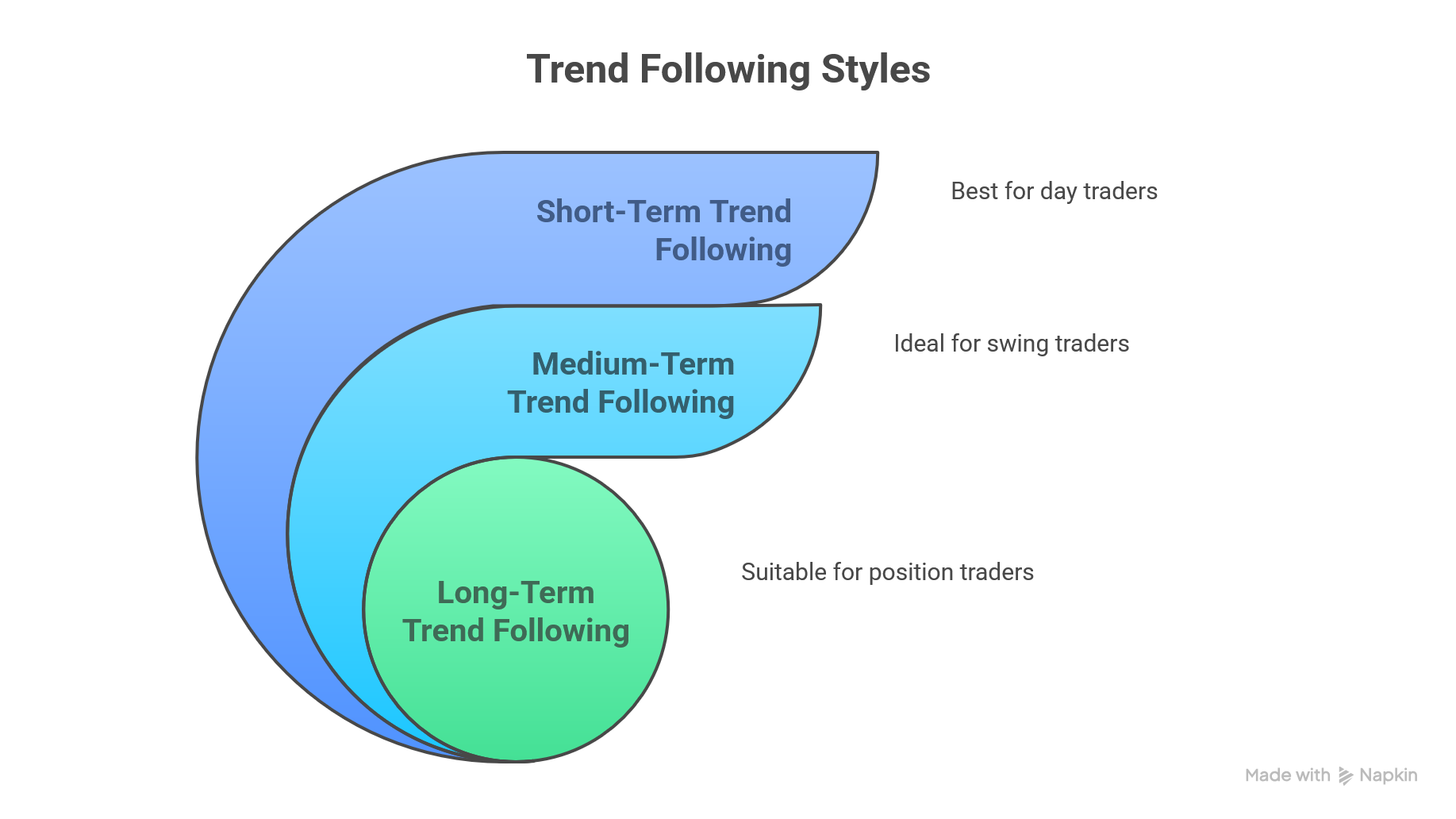

Trend following is flexible. Here are the three main styles:

1. Short-Term Trend Following

- Timeframe: 5-min to 1-hour charts.

- Best for: Day traders.

- Tools: 20 EMA, MACD, Trendlines.

2. Medium-Term Trend Following

- Timeframe: 4-hour to daily charts.

- Best for: Swing traders.

- Tools: 50 SMA, ADX, Price Action.

3. Long-Term Trend Following

- Timeframe: Daily to weekly charts.

- Best for: Position traders.

- Tools: 200 SMA, MACD, ADX.

Step-by-Step: How to Start Using Trend Following

Here’s how beginners can start trend following with confidence:

Step 1: Identify the Trend

- Use 200 EMA or draw a trendline.

- Confirm with higher highs/lows or lower ones.

Step 2: Confirm the Trend’s Strength

- Apply ADX to check if the trend is strong (>25).

Step 3: Enter the Trade

- Use pullbacks to EMAs or support/resistance levels.

- Enter on confirmation from MACD or a bullish/bearish candle pattern.

Step 4: Manage Risk

- Set a stop-loss below recent swing low/high.

- Risk only 1–2% of your capital per trade.

Step 5: Ride the Trend

- Use trailing stop-loss or exit when trend weakens.

Real-Life Example: EUR/USD Trend Trade

In March 2025, EUR/USD formed a clear uptrend with the 50 EMA crossing above the 200 EMA. The ADX showed a reading of 32, confirming strong momentum. A pullback to the 50 EMA provided a low-risk entry, and a MACD crossover confirmed the trend continuation.

Result: Over 3 weeks, the pair gained over 250 pips.

Pro Tips for Beginners

- Stick to one timeframe and master it before adding others.

- Backtest your strategy on historical data.

- Keep a trading journal to track wins and losses.

Summary: Is Trend Following Right for You?

Trend Following is a reliable and beginner-friendly approach to forex trading. By learning to identify and follow market momentum, you reduce guesswork and make smarter, data-backed decisions.

Whether you’re a day trader or long-term investor, there’s a trend following style that fits your needs. Start small, stay consistent, and always protect your capital.

❓ Frequently Asked Questions (FAQ)

Trend following is a trading approach where you identify the current market direction (uptrend or downtrend) and place trades in that same direction. The idea is to ride the wave of the trend until it shows signs of reversing. Instead of guessing tops or bottoms, trend followers focus on what the market is already doing.

Yes, if done correctly. Trend following removes a lot of emotional decision-making by following clear market signals. It’s not about predicting—it’s about reacting with discipline. Beginners often find this easier than complex strategies because it relies on visual cues and proven indicators like moving averages and MACD.

Start by looking at the price action—are the highs and lows going higher (uptrend) or lower (downtrend)? Use moving averages like the 50 EMA and 200 EMA. If the 50 EMA is above the 200 EMA, the trend is likely up. You can also draw trendlines connecting key price points or check the ADX to measure trend strength.

It depends on your style: – Day traders: 15-minute to 1-hour charts – Swing traders: 4-hour to daily – Position traders: Daily to weekly Start with one timeframe, master it, then explore others. For most beginners, the 1-hour or 4-hour timeframe strikes a good balance between clarity and speed.

Here are the top indicators beginners should focus on:- EMA (Exponential Moving Average) – for identifying trends- ADX (Average Directional Index) – for trend strength- MACD – for trend confirmation- Price Action/Trendlines – for context and visual confirmation Keep your chart clean—2 to 3 indicators are enough.

The main risks include: – False breakouts – entering too early before the trend confirms – Whipsaws – frequent trend changes in sideways markets – Late entries – getting in after a large move has already happened To reduce risk, always use a stop-loss and confirm trends with multiple indicators.

Use a trailing stop-loss to lock in profits as the trend moves in your favor. Exit when: – The trendline is broken. – Moving averages cross in the opposite direction. – ADX drops below 20 (trend is weakening). Your exit should be just as planned as your entry—never rely on gut feeling.

Not effectively. Trend following works best in clearly directional markets. In sideways markets, signals become unreliable and you risk being stopped out frequently. It’s better to wait for a breakout or use a different strategy like range trading until a trend reappears.

Both options exist. Many traders build mechanical systems (algorithms) that follow strict rules for entry and exit. Others use a more discretionary approach, combining indicators with market context. As a beginner, start with clear rules, then add flexibility as you gain experience.

Great choice! Here’s a simple beginner roadmap: 1. Open a free demo account on a regulated forex platform. 2. Add the 50 EMA and 200 EMA to your chart. 3. Wait for a crossover and identify higher highs/lows. 4. Enter a trade on a pullback and confirm with MACD. 5. Track your results in a trading journal. Practice until the process becomes second nature. This builds confidence without risking real money.

Take the Next Step

- Share this guide with fellow traders.

- Start backtesting trend following strategies today.

- Follow me for more beginner guides and expert insights.