- What is Forex Volume? Is It Real?

- Types of Forex Volume Data

- Does Forex Volume Show Retail vs. Institutional Traders?

- CME Futures Volume: The Best Proxy for Real Forex Volume

- Types of Volume Data Provided by CME Futures

- How CME Futures Data Helps Forex Traders

- Which Forex Pairs Have CME Futures Contracts?

- Can Retail Traders Access CME Futures Volume Data?

- Conclusion: Should Forex Traders Use CME Volume Data?

- FAQs About Forex and CME Futures Volume

What is Forex Volume? Is It Real?

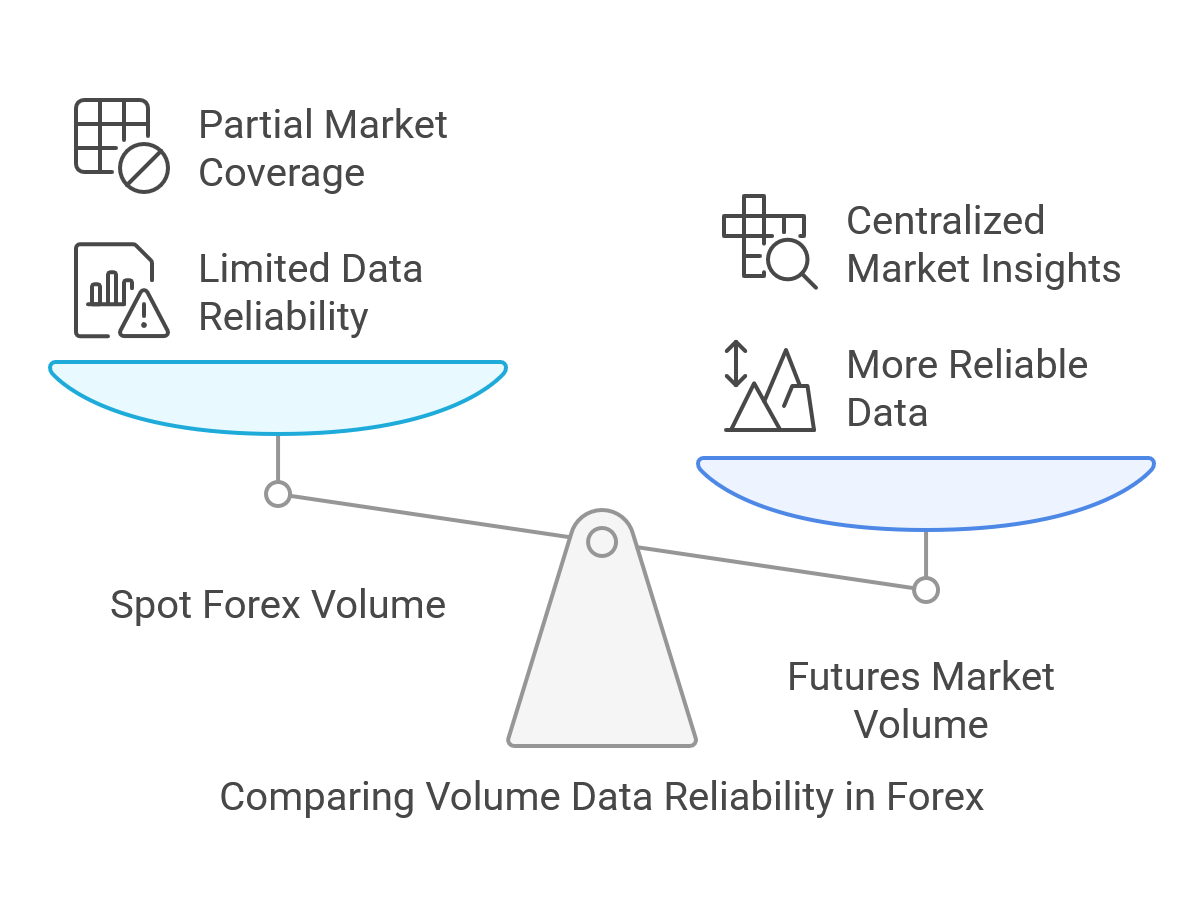

Unlike centralized markets such as stocks or futures, the forex market operates through multiple liquidity providers, brokers, and institutions. This decentralization makes real volume tracking difficult, and traders rely on various methods to estimate market activity.

Types of Forex Volume Data

- Tick Volume – Represents the number of price changes (ticks) in a given time frame, not the actual traded volume.

- Broker-Specific Volume – Some brokers provide their clients’ transaction volumes, but this is limited to their platform only.

- Liquidity Provider Volume – Aggregated data from liquidity providers, ECNs, and banks. Still, it doesn’t represent the entire forex market.

- Futures Market Volume (CME) – The closest thing to real volume in forex. Since futures markets are centralized, their data is more reliable.

Does Forex Volume Show Retail vs. Institutional Traders?

- No, spot forex brokers don’t provide separate data for retail and institutional traders.

- However, CME futures volume can give indirect insights into institutional trading activity.

CME Futures Volume: The Best Proxy for Real Forex Volume

Unlike spot forex, CME Futures provide real traded volume because they are exchange-traded and fully regulated. This makes CME futures the best available proxy for institutional forex trading activity.

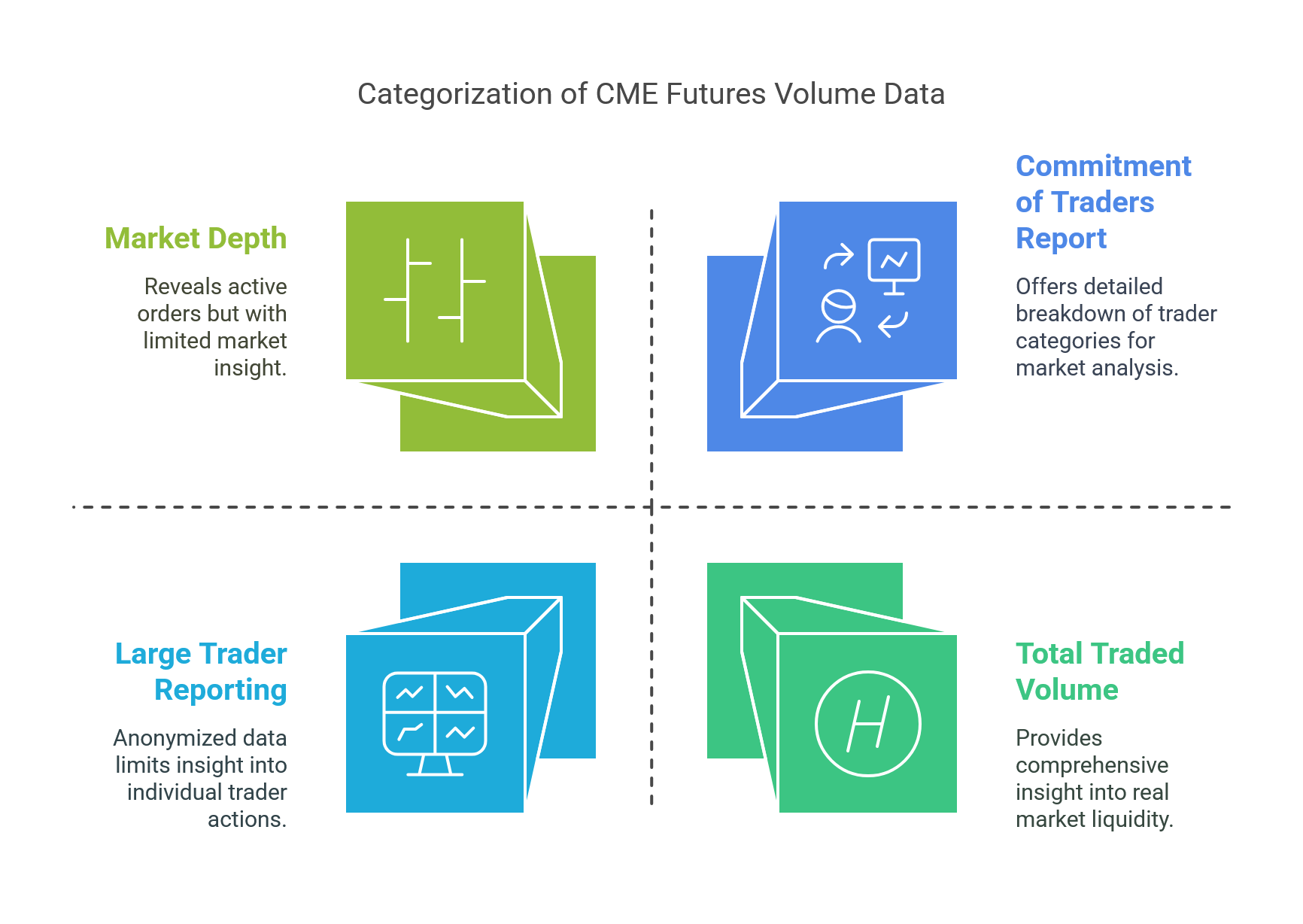

Types of Volume Data Provided by CME Futures

1. Total Traded Volume ✅ (Real)

- The actual number of contracts traded on the CME exchange.

- Unlike spot forex tick volume, this represents real liquidity.

2. Market Depth (Level 2 Data) ✅ (Real)

- Shows active buy and sell orders at different price levels.

- Used to measure liquidity and potential price movements.

3. Time & Sales Data (Order Flow) ✅ (Real)

- Displays every executed trade, including:

- Trade price

- Trade size (contracts)

- Execution time

- Helps analyze market momentum and institutional activity.

4. Open Interest ✅ (Real)

- The number of open positions that haven’t been closed.

- Useful for determining market trends and strength.

5. Commitment of Traders (COT) Report ✅ (Aggregated Data)

- Published weekly by the CFTC (Commodity Futures Trading Commission).

- Breaks down traders into three categories:

- Commercial Hedgers (Big corporations hedging forex exposure)

- Large Speculators (Hedge funds and institutions)

- Small Speculators (Retail traders)

6. Large Trader Reporting ✅ (Aggregated Data)

- CME tracks large trader positions but anonymizes the data.

- Helps identify when big players enter or exit the market.

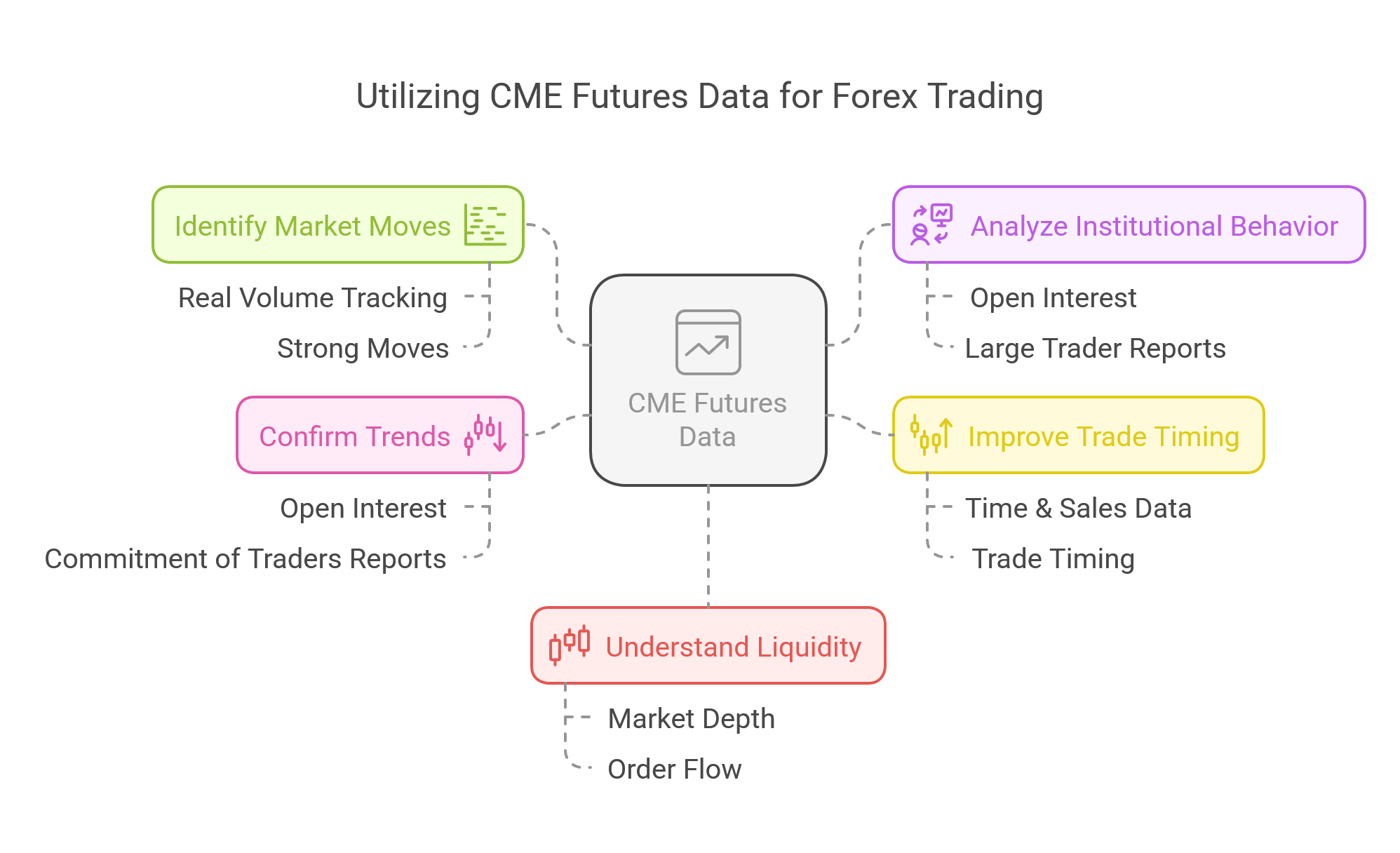

How CME Futures Data Helps Forex Traders

Since forex spot volume is unreliable, traders can use CME Futures data as an alternative to:

- Identify strong market moves by tracking real volume.

- Analyze institutional behavior using open interest and large trader reports.

- Improve trade timing with time & sales data.

- Confirm trends with open interest and commitment of traders reports.

- Understand liquidity using market depth and order flow.

How to Improve Trading Strategy: Probability of the Next Move

Which Forex Pairs Have CME Futures Contracts?

CME offers currency futures contracts for major pairs, including:

- EUR/USD

- GBP/USD

- USD/JPY

- AUD/USD

- USD/CAD

- USD/CHF

- Emerging market currencies (USD/MXN, USD/BRL, etc.)

Can Retail Traders Access CME Futures Volume Data?

Yes! However, real-time data requires a paid subscription. Here’s how you can access it:

- CME Direct – The official platform for real-time futures data.

- Broker Feeds – Platforms like NinjaTrader, TradingView, and CQG offer CME data subscriptions.

- Delayed Free Sources – Websites like CME Group provide delayed data for free.

Conclusion: Should Forex Traders Use CME Volume Data?

✅ Yes! CME futures data is the closest thing to real forex volume.

❌ Spot forex volume is unreliable and mostly an approximation.

✅ CME provides transparency, real liquidity insights, and institutional trading data.

Final Takeaways:

- If you trade forex based on volume, CME futures are the best data source.

- Futures volume can help confirm trends, liquidity levels, and institutional activity.

- Retail traders can access CME data through paid broker feeds or free delayed reports.

Are you ready to take your forex trading to the next level with real futures volume data?

Start analyzing CME futures today! 🚀

FAQs About Forex and CME Futures Volume

No, most spot forex brokers provide tick volume, which measures price changes, not actual trades.

Yes! CME futures provide real traded volume, whereas forex brokers only estimate volume.

Not directly. However, the COT report and order flow analysis can help estimate institutional activity.

You can subscribe to CME Direct or get real-time data via brokers like NinjaTrader, TradingView, or CQG.

Forex volume isn’t centralized, so it’s not 100% accurate like in stock markets. However, brokers provide “tick volume,” which counts price changes. Surprisingly, it often mirrors real volume trends closely enough for most traders.

In futures, volume reflects the total number of contracts traded, helping traders spot trends, reversals, and confirm breakouts. Higher volume typically confirms strong interest and momentum behind a price move.

Volume reveals market participation. Even though Forex lacks centralized volume, tick volume still highlights shifts in interest, potential breakouts, or fading trends. It’s a powerful confirmation tool when paired with price action.

Yes volume profile shows where most trading activity occurs at specific price levels. It highlights key support/resistance zones and fair value areas, making it great for planning entries and exits in ranging or trending markets.

While no indicator is perfect, Volume Profile, On-Balance Volume (OBV), and Volume Weighted Average Price (VWAP) are trusted by pros. For Forex, combining tick volume with price action is often the most reliable approach.

Yes when used correctly. Volume trading helps confirm trends, spot fakeouts, and improve timing. It becomes especially powerful when combined with key levels, candlestick patterns, and higher timeframe analysis.

Increased volume means more participants are active, often signaling the beginning or confirmation of a strong trend. But sudden spikes can also mean exhaustion context matters!

Volume tells you how strong or weak a price move is. Rising volume means conviction. Falling volume may indicate a lack of interest or a possible reversal. It adds a layer of market psychology to technical analysis.

A “good” P/E ratio depends on the industry. Generally, 15–25 is seen as reasonable. Low P/E may indicate undervaluation, but also potential risk. Always compare P/E with industry peers and company growth outlook.

Optimize Your Trading With Real Volume Data!–

If you want better trade entries, trend confirmation, and deeper market insights, switch to

today! 📊🚀