Bayesian is one of the most powerful ways that you can find relation between your losing trade and winning trade. in this article we look into it and we’ll use it to improve a trading strategy.

Im Using Python 3.10 and lets go to Improve some Unprofitable Strategy. Hole code will be published to github and i put the link at the end of this article.

The Symbol i used for this is XAUUSD and the trading strategy is simple! 50 period simple moving average cross close price. we want to find out how this strategy is making loss and find a relation between winning trades and some other data.

Install Dependencies :

pip install scikit-learn pandas pgmpy numpy matplotlib networkximport pandas as pd

from sklearn.preprocessing import KBinsDiscretizer

from pgmpy.estimators import HillClimbSearch, BicScore, MaximumLikelihoodEstimator

from pgmpy.models import BayesianNetwork

from pgmpy.inference import VariableElimination

import numpy as np

import networkx as nx

import matplotlib.pyplot as plt

import matplotlib

matplotlib.use('QtAgg')

pd.options.mode.chained_assignment = None

# Load your OHLC data

data = pd.read_csv('XAUUSD_M1_2.csv')

# Conver the Datetime to datetime object

data['Date'] = pd.to_datetime(data['Date'])

# Split the hour for future

data['hour'] = data['Date'].dt.hour

# Calculate the 50-period Simple Moving Average

data['SMA50'] = data['Close'].rolling(window=10).mean()

# Generate signals when close price crosses over or under SMA50

data['Signal'] = 0

data['Signal'][10:] = np.where(data['Close'][10:] > data['SMA50'][10:], 1, -1)

data['Position'] = data['Signal'].diff()Our main goal is generate trading signals based on our strategy which we did and then find relation of them between other features like Hour, Performance of Last 10 candle and Bulllish/Bearish Ratio

Specify Losing and Winning Trades:

# Define minimum profit to consider a trade profitable

min_profit = 0.0001 # Adjust as needed (e.g., 1% profit)

# Initialize the Profit column

data['Profit'] = np.nan

# Calculate profit for each signal

for i in range(len(data)):

if data['Position'].iloc[i] == 2: # Buy signal

entry_price = data['Close'].iloc[i]

for j in range(i + 1, len(data)):

price_change = (data['Close'].iloc[j] - entry_price) / entry_price

if price_change >= min_profit or price_change <= -min_profit:

data['Profit'].iloc[i] = price_change

break

elif data['Position'].iloc[i] == -2: # Sell signal

entry_price = data['Close'].iloc[i]

for j in range(i + 1, len(data)):

price_change = (entry_price - data['Close'].iloc[j]) / entry_price

if price_change >= min_profit or price_change <= -min_profit:

data['Profit'].iloc[i] = price_change

break

# Label signals as profitable (1) or not (0)

data['Profitable'] = np.where(data['Profit'] >= min_profit, 1, -1)

# Function to compute rolling mean for the last 5 non-NaN values

def rolling_mean_last_5_non_na(series):

non_na_series = series.dropna()

if len(non_na_series) == 0:

return None

return non_na_series.tail(5).mean()

# Apply a rolling window and use the custom function

data['Last10CandlePerf'] = data['Close'].pct_change().rolling(window=10).mean()

# Identify bullish candles

data['Bullish'] = (data['Close'] > data['Open']).astype(int)

# Identify bearish candles

data['Bearish'] = (data['Close'] < data['Open']).astype(int)

# Calculate rolling sum of bullish candles over the last 20 periods

data['Bullish_Sum'] = data['Bullish'].rolling(window=20).sum()

# Calculate rolling sum of bearish candles over the last 20 periods

data['Bearish_Sum'] = data['Bearish'].rolling(window=20).sum()

# Calculate BullishRatio

data['BullishRatio'] = data['Bullish_Sum'] / (data['Bullish_Sum'] + data['Bearish_Sum'])

# Handle division by zero by replacing NaN with 0

data['BullishRatio'] = data['BullishRatio'].fillna(0)We marked Profitable Trades with 1 and Losing Trades with -1 and then added some features like last 10 candle performance and bullish ratio.

Transform Data :

# Prepare the dataset for the Bayesian Network

df = pd.DataFrame(data=data, columns=['hour', 'BullishRatio','Profitable','Last10CandlePerf'])

df = df.fillna(0)

# Discretize the continuous data (Hour) into 24 bins (0=> 00:00, 13=> 13:00)

discretizer_hour = KBinsDiscretizer(n_bins=24, encode='ordinal', strategy='uniform')

df['Hour_Binned'] = discretizer_hour.fit_transform(df[['hour']])

discretizer_bullishratio = KBinsDiscretizer(n_bins=4, encode='ordinal', strategy='uniform')

df['BullishRatio_Binned'] = discretizer_bullishratio.fit_transform(df[['BullishRatio']])

discretizer_last10ref = KBinsDiscretizer(n_bins=10, encode='ordinal', strategy='uniform')

df['Last10CandlePerf_Binned'] = discretizer_last10ref.fit_transform(df[['Last10CandlePerf']])

# Drop the original continuous 'hour','BullishRatio','Last10CandlePerf' column since it's been discretized

df = df.drop(columns=['hour','BullishRatio','Last10CandlePerf'])

data2 = dfLearning The Structure (find profitable trade relation) :

# Learn the structure using the Hill Climbing algorithm

hc = HillClimbSearch(data2)

best_model = hc.estimate(scoring_method=BicScore(data2))

# Print the learned structure

print("Learned Bayesian Network Structure:")

print(best_model.edges())

This code is part of a process for learning the structure of a probabilistic graphical model, particularly a Bayesian Network, using the Hill Climbing algorithm.

HillClimbSearch used to learn the structure of a Bayesian Network from data. The structure refers to the directed acyclic graph (DAG) that represents the dependencies between variables in the dataset.

BicScore(data2): This creates an instance of the BIC (Bayesian Information Criterion) score to evaluate the goodness of fit for different network structures

Output :

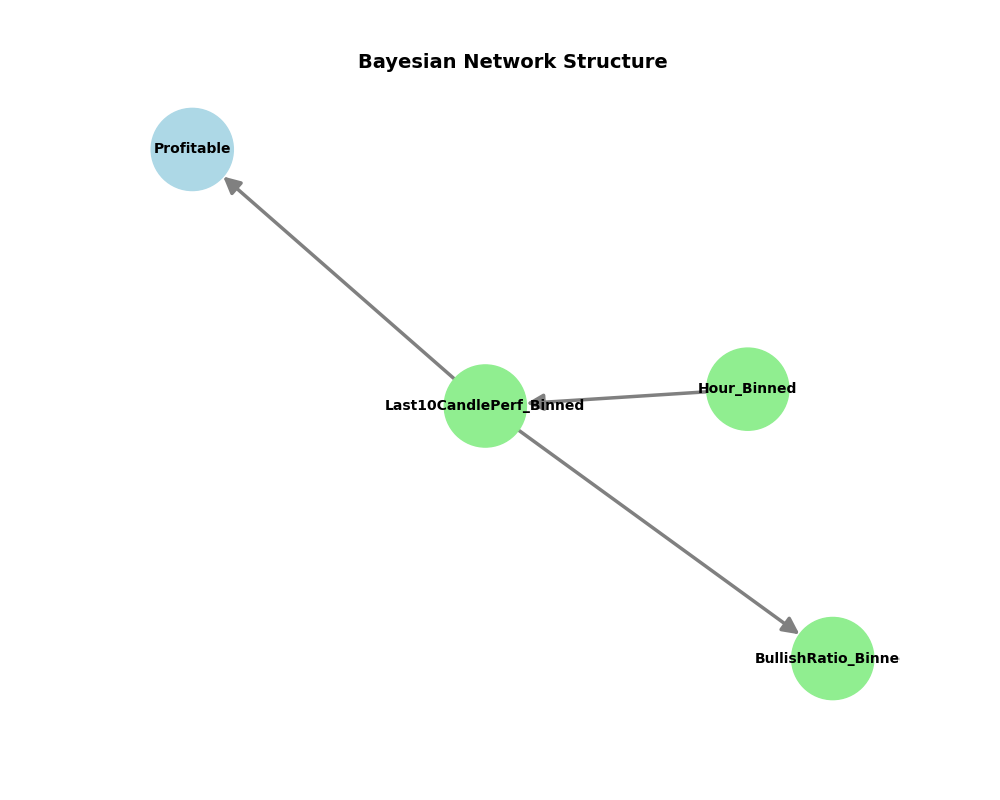

Learned Bayesian Network Structure:

[('Hour_Binned', 'Last10CandlePerf_Binned'), ('Last10CandlePerf_Binned', 'BullishRatio_Binned'), ('Last10CandlePerf_Binned', 'Profitable')]This learned Bayesian Network structure represents the probabilistic dependencies between different variables (or “nodes”) based on the data:

('Hour_Binned', 'Last10CandlePerf_Binned'):Hour_BinnedinfluencesLast10CandlePerf_Binned.- This suggests that the performance of the last 10 candles (market indicators) depends on the hour of the day (in binned format).

('Last10CandlePerf_Binned', 'BullishRatio_Binned'):Last10CandlePerf_BinnedinfluencesBullishRatio_Binned.- The performance of the last 10 candles affects the ratio of bullish candles in that period, indicating that recent candle performance can determine bullish activity.

('Last10CandlePerf_Binned', 'Profitable'):Last10CandlePerf_Binnedalso influencesProfitable.- The performance of the last 10 candles has a direct impact on whether a trade is profitable.

Fit the Model :

# Fit the model with Conditional Probability Distributions (CPDs)

model = BayesianNetwork(best_model.edges())

model.fit(data2, estimator=MaximumLikelihoodEstimator)

# Perform inference

inference = VariableElimination(model)best_model.edges() provides the set of edges (relationships) between the variables (nodes) in the network. These edges represent the conditional dependencies between variables.

The Bayesian Network is initialized using these edges, creating the skeleton of the network without yet specifying the Conditional Probability Distributions (CPDs).

This step fits the Bayesian Network model to the data (data2) using the Maximum Likelihood Estimator (MLE).

The MaximumLikelihoodEstimator is used to estimate the Conditional Probability Distributions (CPDs) for the nodes in the network based on the data. The MLE estimates the CPDs by calculating probabilities from the observed data

VariableElimination(model): This initializes an inference object using the Variable Elimination algorithm, which is a method for performing probabilistic inference on the Bayesian Network.

Plot the Result

# Define the learned structure as a list of edges (directed connections)

edges = best_model.edges()

# Create a directed graph

G = nx.DiGraph()

# Add the edges to the graph

G.add_edges_from(edges)

# Draw the graph

plt.figure(figsize=(10, 8)) # Slightly larger figure for better visibility

pos = nx.spring_layout(G, seed=42) # Add a seed for consistent positioning

# Define node colors based on the variable type

node_colors = ['lightgreen' if 'Binned' in node else 'lightblue' for node in G.nodes()]

plt.gca().set_facecolor((211/255, 202/255, 207/255, 0.8))

# Draw the graph with professional style adjustments

nx.draw(G, pos, with_labels=True, node_color=node_colors,

node_size=3500, font_size=10, font_weight='bold', arrowsize=25,

edge_color='gray', width=2.5) # Increased edge width for clarity

# Add edge labels (optional - currently empty labels)

edge_labels = {edge: "" for edge in G.edges()}

nx.draw_networkx_edge_labels(G, pos, edge_labels=edge_labels,

font_color='red', font_size=9)

# Add a clear, professional plot title

plt.title("Bayesian Network Structure", fontsize=14, fontweight='bold', pad=20)

# Show the plot

plt.show()

Summary:

This structure shows how hourly market performance affects candle performance, which in turn influences both the bullish ratio and the profitability of trades.

Github Repository : Unlock Profitable Trades with Ai

Also you can check this :

Mastering Forex Backtesting : Key Strategies for Profitable Trading and Market Sentiment Analysis

Forecasting stock market index daily direction: A Bayesian Network approach