Will S&P 500 crash in 2025 ? lets Check!

What Can We See in the S&P 500 Chart?

Twenty-five years ago, in the year 2000, the S&P 500 fell 50% from its all-time high. That year was also historically significant for XAUUSD, which hit a low point.

Will this happen again? Let’s piece together the puzzle:

2025: A Challenging Year for the S&P 500

The primary reason 2025 could be difficult for the S&P 500 is that it is currently overvalued.

What Does It Mean When an Asset Is Overvalued?

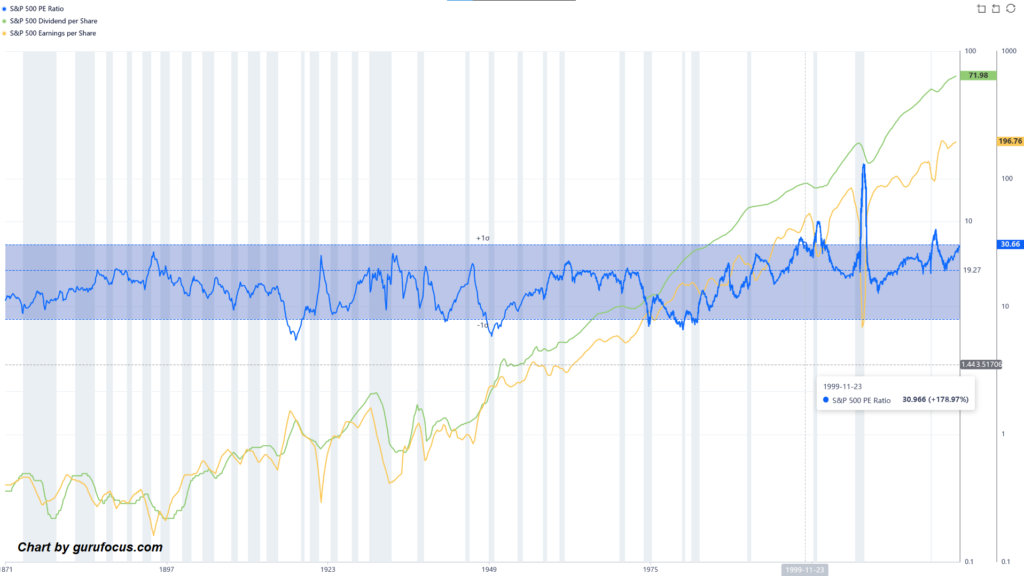

The P/E ratio (Price-to-Earnings ratio) is a critical factor in determining whether an asset is overvalued. As of December 3, 2024, the S&P 500’s P/E ratio stands at 30.66. This high ratio indicates it is not an ideal time to open a buy position.

Analyzing the S&P 500 P/E Ratio Chart

The P/E ratio chart shows a value of around 30, which suggests it would take 30 years to double your investment through dividend shares. This figure is similar to the P/E ratio during the year 2000, a period also marked by a major correction in the S&P 500.

What Can We Expect in This Situation?

When an asset is overvalued, it is challenging to pinpoint the exact time to sell. During such periods, shareholders and institutional investors often heavily market the asset to sustain its appeal.

This marketing creates a false sense of security for investors. They may feel as though they’re investing in a “safe haven” and could observe significant price spikes or surges on the chart.

Additionally, you’ll frequently find the asset making headlines on TV and financial websites, largely due to paid advertising and promotion.

So, don’t expect the S&P 500 to crash immediately after reading this article on Global-FXS.com. This is a long-term analysis, and such a correction is likely to happen by the end of 2025.

From a financial perspective, this high P/E ratio indicates that the asset carries very high risk.

Why the Crash Is Inevitable (Even if EPS Grows)

Some analysts argue that EPS (Earnings Per Share) growth could prevent a crash. However, let’s examine why even with EPS growth, a correction is inevitable:

Between 2000 and 2024, the EPS of the S&P 500 grew by 400%, averaging a growth rate of 16% per year. Despite this significant growth, the P/E ratio has not decreased to safe levels. This highlights that, even with further EPS growth, the S&P 500 will remain overvalued, making a correction inevitable.

What Will Happen Next?

Experienced investors are familiar with the following pattern during market peaks:

- Advertise at All-Time Highs (ATH): Big players sell to retail investors, impatient traders, and short-term thinkers. As a result, prices surge temporarily.

- Pullback: Prices drop, signaling a correction.

- Re-advertise: The asset is marketed again, causing prices to rise. Emotional investors buy during this surge, allowing big players to offload their holdings.

This pattern can become increasingly complex. When most investors believe the S&P 500 is safe, they may hesitate to sell, even in the face of a crash. Emotional investors often end up selling at a 30% loss or more, a painful decision.

So based on All Data we have we can Expect The S&P 500 crash in 2025 will happen!

PE Ratio Source : gurufocus