Important Points: Forex Broker Regulations and Requirements

- Why Doesn’t Your Trading Account Include Regulatory Coverage?

- List of Reliable Forex Broker Regulations

- Key Elements to Consider When Choosing a Forex Broker

- Regulation affects in Forex Brokers

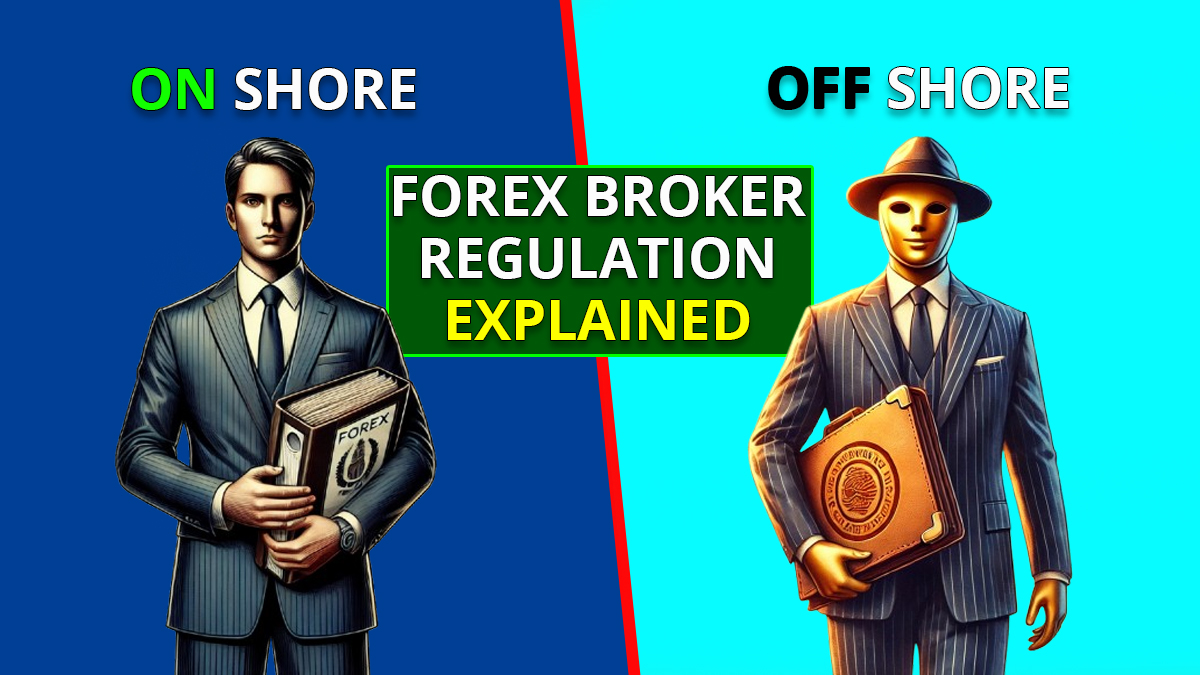

Why Regulations Don’t Cover Your Trading Account?

Even if you sign up with a forex broker that has a reliable regulation, under certain conditions, your trading account may not be covered for two reasons:

- Country :

If your country is blocked by that regulation, it doesn’t matter how good the broker’s regulation is—you won’t be covered.

2. Leverage :

If your trading account uses leverage above the regulation’s permitted limit, you will not qualify for regulatory coverage.

List of Reliable Forex Broker Regulations

| Regulator | Country/Region | Blocked/Excluded Countries | Maximum Leverage Allowed | Initial License Cost (Approx.) |

|---|---|---|---|---|

| FCA (Financial Conduct Authority) | United Kingdom | USA, Canada, Japan, North Korea, Iran, Syria | 1:30 (Retail) | £25,000 – £50,000 |

| ASIC (Australian Securities and Investments Commission) | Australia | USA, Canada, North Korea, Iran, Syria, Myanmar | 1:30 (Retail) | AUD 35,000 – AUD 50,000 |

| CySEC (Cyprus Securities and Exchange Commission) | Cyprus (EU member) | USA, Canada, Japan, North Korea, Iran, Syria | 1:30 (Retail) | €25,000 – €40,000 |

| CFTC (Commodity Futures Trading Commission) | United States | Non-U.S. clients generally excluded, such as residents of EU and Asia | 1:50 | $1,000,000+ |

| NFA (National Futures Association) | United States | Non-U.S. clients generally excluded | 1:50 | $125,000 – $250,000 |

| FSCA (Financial Sector Conduct Authority) | South Africa | USA, Canada, North Korea, Iran, Syria | 1:200+ | ZAR 15,000 – ZAR 25,000 |

| BaFin (Federal Financial Supervisory Authority) | Germany | USA, North Korea, Iran, Syria | 1:30 (Retail) | €50,000 – €100,000 |

| MAS (Monetary Authority of Singapore) | Singapore | USA, Canada, North Korea, Iran, Syria | 1:20 (Retail FX Margin) | SGD 100,000 – SGD 250,000 |

| FSA (Financial Services Authority) | Seychelles | USA, North Korea, Iran, Cuba, Syria | 1:500 | $15,000 – $30,000 |

| DFSA (Dubai Financial Services Authority) | United Arab Emirates (DIFC) | USA, North Korea, Iran, Syria | 1:50 | $40,000 – $100,000 |

| SCB (Securities Commission of The Bahamas) | Bahamas | USA, Canada, North Korea, Iran, Syria | 1:200+ | $20,000 – $50,000 |

| VFSC (Vanuatu Financial Services Commission) | Vanuatu | USA, North Korea, Iran, Syria | 1:500 | $30,000 – $50,000 |

| FSC (Financial Services Commission) | Mauritius | USA, North Korea, Iran, Syria | 1:500 | $25,000 – $50,000 |

| FINMA (Swiss Financial Market Supervisory Authority) | Switzerland | USA, Canada, North Korea, Iran, Syria | 1:20 | CHF 200,000+ |

Key Elements to Consider When Choosing a Forex Broker

Some forex brokers advertise their regulation but use separate website domains for countries that are blocked from their reliable regulation. This means you and your country are not covered by that regulation.

More professional forex brokers with advanced CRM systems often operate a single platform for all traders. However, if your country is blocked or your trading account leverage exceeds the regulation’s limit, your account will be classified and processed under their offshore regulation.

How to Choose a Forex Broker: Key Factors for Reliable Selection

Regulation affects in Forex Brokers

Client Protection and Security

- Segregated Funds: Regulated brokers are often required to keep client funds in separate accounts, ensuring they are not used for operational expenses or at risk in case of broker insolvency.

- Compensation Schemes: Many regulated brokers must participate in investor compensation schemes, providing an extra layer of security if the broker fails.

Operational Transparency and Fair Practices

- Leverage Limits: Regulations often impose restrictions on maximum leverage to protect traders from excessive risk.

- Transparent Pricing: Regulated brokers are held to high standards regarding the accuracy of spreads, fees, and trade execution practices to ensure fair treatment of clients.

Dispute Resolution and Accountability

- Complaint Handling: Regulated brokers must follow strict processes for resolving client disputes and are subject to oversight by regulatory bodies.

- Audit and Reporting: Regular audits and financial reporting are mandatory for regulated brokers, ensuring accountability and reducing the risk of fraud.