What is Intuition in Forex Trading?

Intuition in forex trading refers to the subconscious ability to make trading decisions based on experience, pattern recognition, and emotions rather than structured analysis. It often manifests as a “gut feeling” or instinctive reaction to market movements.

While experienced traders may develop an intuitive sense of the market, relying solely on intuition can lead to impulsive decisions, increased risk exposure, and potential losses.

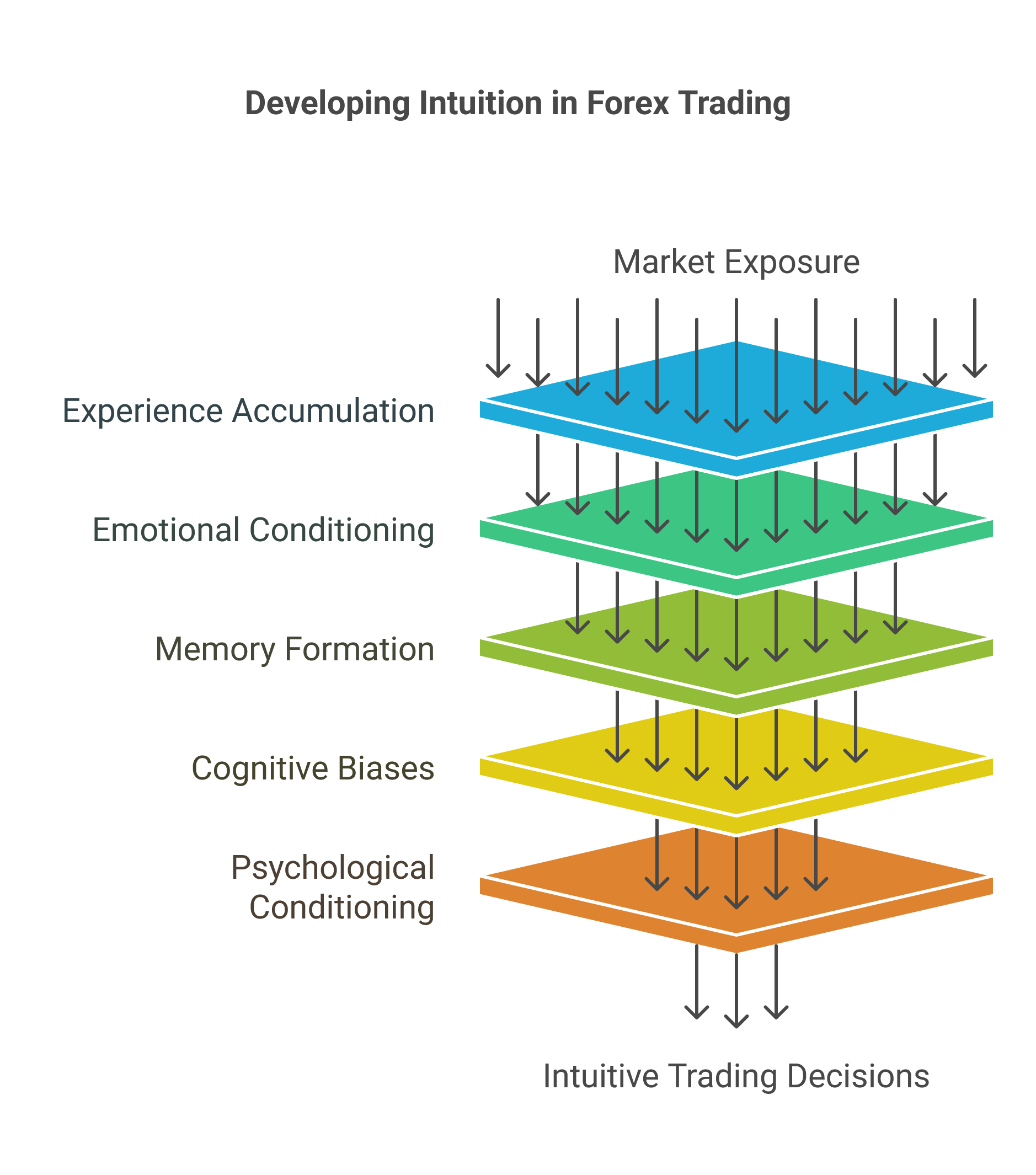

How is Intuition Created in Forex Trading?

Intuition develops over time through repeated exposure to market patterns, price action, and trading decisions. Key factors shaping intuition include:

1. Experience & Repetitive Patterns

- Analyzing price movements repeatedly strengthens neural connections in the brain, leading to subconscious pattern recognition.

- Traders who have spent years in the market develop an intuitive understanding of price behavior under different conditions.

2. Emotional Responses to Market Conditions

- Emotional reactions to profits and losses reinforce certain behaviors, causing traders to develop biases.

- Fear, greed, and euphoria often drive intuitive trades, sometimes leading to irrational decisions.

3. Memory of Past Trades

- Past successes and failures shape intuition, leading traders to favor certain setups based on previous experiences.

- However, market conditions constantly change, making past-based intuition unreliable at times.

4. Cognitive Biases

- Confirmation bias: Seeing what you expect rather than what is real.

- Recency bias: Prioritizing recent events over historical data.

- Overconfidence bias: Believing past success guarantees future success.

5. Market Noise & Psychological Conditioning

- Some traders develop intuition based on random market movements rather than valid patterns.

- Psychological conditioning causes traders to react instinctively based on prior emotional experiences, leading to unpredictable trading behavior.

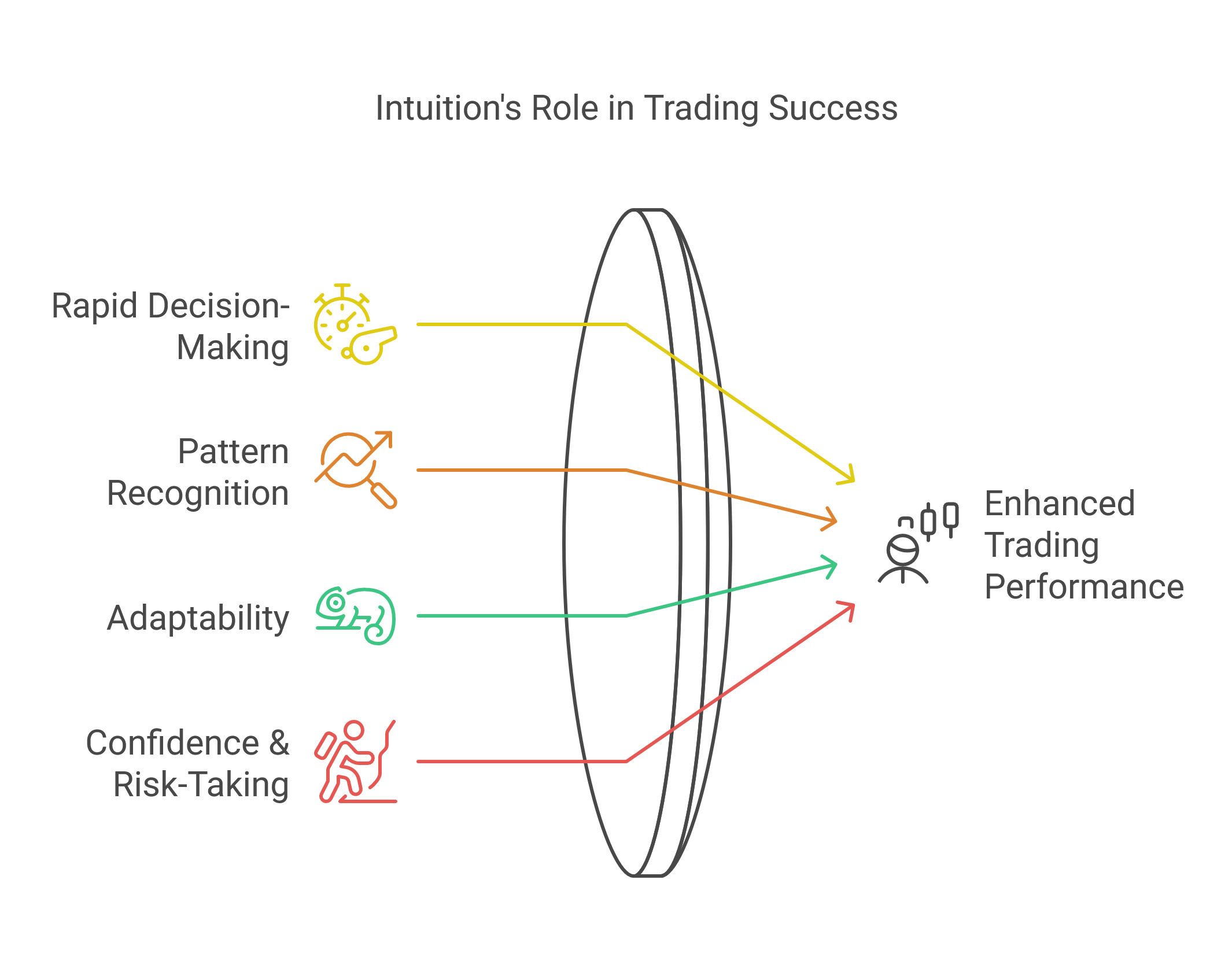

The Impact of Intuition in Trading

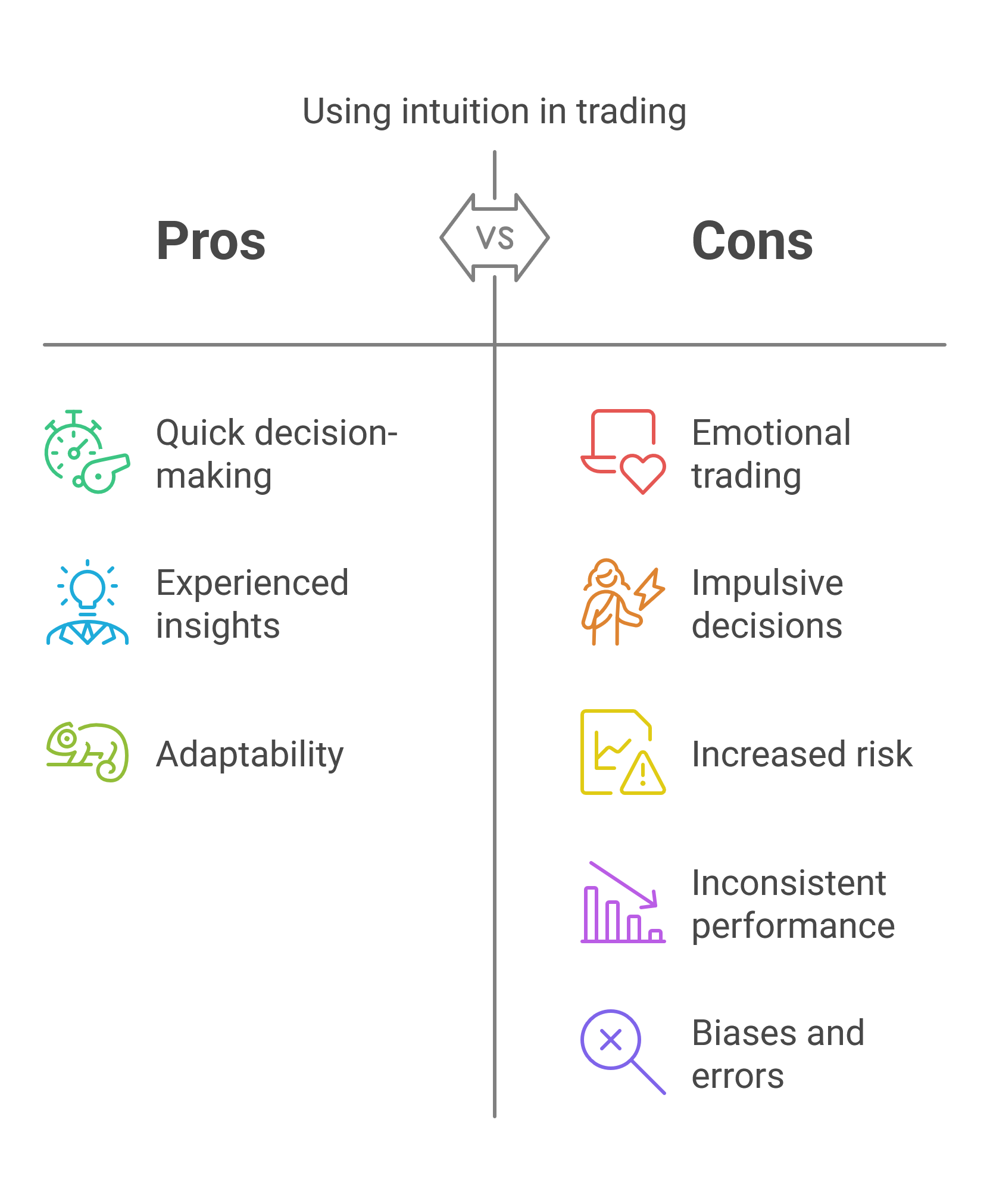

Intuition can influence a trader’s performance in both positive and negative ways.

Positive Impact of Intuition

✅ Rapid Decision-Making

- Experienced traders can make quick, effective decisions without overanalyzing.

- This skill is especially useful in fast-moving markets or scalping strategies.

✅ Pattern Recognition

- Traders can instinctively spot trends, reversals, and breakouts before they fully develop.

- This can provide a competitive edge in volatile markets.

✅ Adaptability in Unpredictable Markets

- Intuition helps traders react swiftly to unexpected news events, economic releases, and market shifts.

✅ Confidence & Risk-Taking

- A well-developed intuitive sense can help traders take calculated risks, which are necessary for long-term success.

Negative Impact of Intuition

❌ Emotional Trading

- Intuition often stems from emotions rather than logic, leading to fear-based exits or greed-driven entries.

❌ Ignoring Trading Plans & Strategies

- Traders may abandon structured strategies because they “feel” a trade will go in a certain direction, leading to inconsistent results.

❌ Overtrading & Revenge Trading

- Overconfidence in intuition can cause traders to take excessive trades, especially after losses.

❌ Bias & Misinterpretation of Data

- Intuitive decisions may be based on false patterns or cognitive biases, leading to poor risk-reward ratios.

How to Prevent the Negative Effects of Intuition

To balance intuition with structured decision-making, traders should incorporate analytical methods into their trading process.

1. Follow a Rule-Based Trading System

- Stick to predefined entry and exit rules to avoid emotional trading.

- Use checklists before taking trades.

2. Use Data & Probability-Based Decision Making

- Backtest strategies to validate patterns.

- Utilize quantitative methods to confirm intuition-based insights.

3. Implement Risk Management Techniques

- Use stop-losses and position sizing to protect against impulsive trades.

- Avoid increasing lot sizes based on intuition alone.

4. Journal Trades & Review Performance

- Keep a trading journal to differentiate rational trades from emotional ones.

- Review trades weekly to analyze whether intuition contributed positively or negatively.

5. Control Psychological Triggers

- Train yourself to recognize when emotions influence decisions.

- Use meditation, discipline, or a cool-down period before placing trades.

6. Combine Intuition with Quantitative Models

- If you feel a strong intuitive sense about a trade, verify it with technical analysis, fundamental analysis, and AI-driven signals.

- Use algorithmic trading models to test intuition-based setups objectively.

Conclusion

Intuition in forex trading is a double-edged sword—it can be a valuable tool when based on experience and pattern recognition, but it can also lead to emotional trading, biases, and losses.

Successful traders find a balance between intuition and data-driven decision-making by using structured strategies, risk management, and trading discipline. To harness intuition effectively, traders should validate their gut feelings with analysis, avoid emotional trading, and continuously refine their skills through structured learning and market observation.