What is Forex Arbitrage?

Forex arbitrage is a complex trading strategy rooted in capitalizing on price differences across brokers, currency pairs, and interest rates.

Forex arbitrage involves leveraging price discrepancies to secure profits with minimal risk, exploiting momentary misalignments in currency pair prices or interest rates.

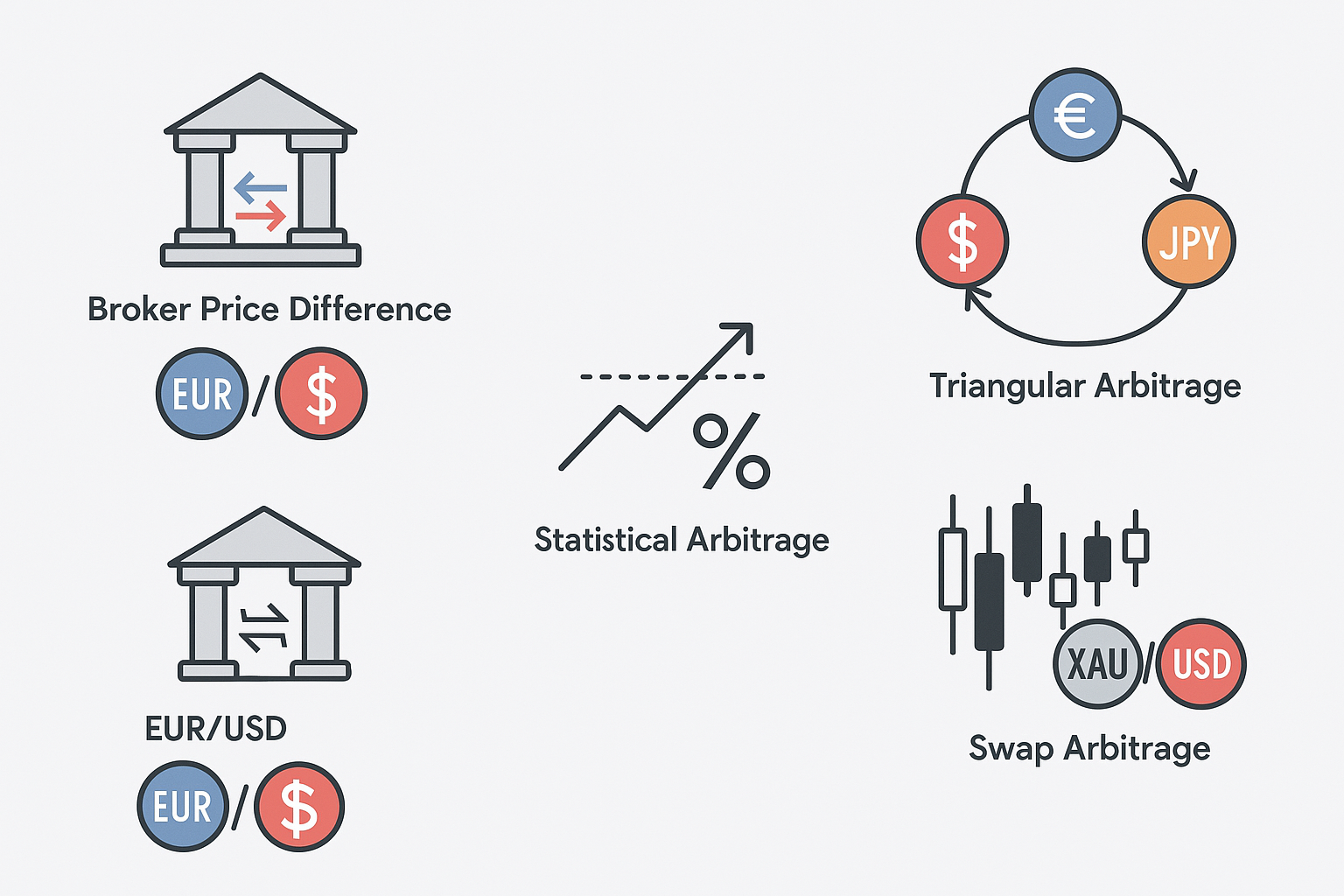

Types of Forex Arbitrage:

- Broker Price Difference (Cross-Border Arbitrage): Traders profit from price variations of a currency pair across two brokers. For instance, if EUR/USD is priced slightly differently across platforms, a trader buys on one and sells on the other, aiming for price normalization.

- Triangular Arbitrage: This advanced strategy requires executing trades across three currency pairs. While profitable, it demands lightning-fast execution and precision.

- Interest Rate Arbitrage (Carry Trade): By trading currency pairs with different interest rates, traders gain from the difference in rates, effectively earning on overnight holding fees.

- Statistical Arbitrage: Relying on mathematical models, this approach identifies price trends and potential reversals. Many use statistical patterns, such as assuming EUR/USD might not exceed a certain rise within a day.

- Swap Arbitrage: By opening positions during end-of-day trading, traders aim to profit from overnight swap rates, typically targeting gold (XAU/USD) or other stable pairs.

Forex Arbitrage : Statistical Arbitrage Model Explained

Which Forex Arbitrage Methods Suit Retail Traders?

For individual traders, statistical arbitrage stands out. This approach requires less speed and lower risk, making it accessible without high-frequency trading setups.

Is Forex Arbitrage the Only Way to Profit?

No, although it’s a popular shortcut, professional traders seldom rely solely on arbitrage. Most who focus on arbitrage are drawn by its perceived simplicity, but this often leads to constant strategizing without true expertise. By focusing on learning core trading skills, many could build sustainable profits rather than chasing fleeting opportunities in arbitrage.

How to Profit from Arbitrage in Forex

Mastering mathematical analysis and understanding currency correlations, such as the relationship between EUR/USD and GBP/USD, provides valuable insights. Studying how various EUR-based pairs move can reveal the true market trend for the Euro.

The Best Arbitrage Strategy

A robust approach involves tracking all pairs linked to a specific currency (like EUR) to determine its overall market direction. By analyzing multi-pair movements, traders can make more informed trades.

Summary

Forex arbitrage strategies range from broker price differences to statistical and swap arbitrage. While not essential for every trader, statistical arbitrage offers potential for individuals with a good grasp of trends and price behavior. Yet, focusing on traditional trading skills might prove more profitable in the long run.

Frequently Asked Questions

Yes, forex arbitrage can be profitable especially when executed with precision, speed, and low transaction costs. It takes advantage of price discrepancies across different brokers or markets to generate risk-free or low-risk profits. However, profits are often small per trade and require automation and advanced tools to be sustainable at scale.

Absolutely. Exchange arbitrage is legal in most countries, including those with regulated forex markets. It involves buying and selling assets across different exchanges to profit from temporary price differences. Still, traders should ensure compliance with local financial laws and broker terms of service.

Arbitrage is generally considered a low-risk trading strategy, but it’s not risk-free. Risks include latency delays, slippage, transaction costs, and platform restrictions. In fast-moving markets like forex, even milliseconds matter so execution speed is crucial for minimizing risk.

A simple example of forex arbitrage: EUR/USD is trading at 1.1000 on Broker A and 1.1010 on Broker B. A trader buys from Broker A and simultaneously sells on Broker B, locking in a 10-pip profit. This type of inefficiency doesn’t last long, which is why automation is key.

Forex arbitrage is legal. It’s a form of smart trading that relies on publicly available data. However, some brokers may restrict or penalize such strategies, especially if they believe the trader is exploiting latency. Always review your broker’s terms.

Arbitrage is designed to be a profit strategy by nature. It exploits price differences to lock in gains. While it doesn’t guarantee profits in every trade especially due to timing or technical errors it is fundamentally intended for low-risk profit generation.

Usually, no one directly “loses” in a pure arbitrage situation. However, traders who fail to execute arbitrage fast enough or pay high fees may incur losses. Brokers and exchanges may also experience temporary liquidity shifts, but arbitrage helps correct inefficiencies in the long run.

To become a day trader, start by learning market fundamentals, developing a strategy, and practicing on demo accounts. Choose a reliable broker, manage risk carefully, and build discipline. Focus on liquidity-rich instruments like forex, and always analyze economic news and technical signals.

Learn arbitrage trading by studying forex market mechanics, reading guides like our in-depth article on Forex Arbitrage, and practicing with demo platforms. Use real-time data tools, arbitrage scanners, and understand latency arbitrage, triangular arbitrage, and statistical models.

Related Topics :

Thank you for sharing this article with me. It helped me a lot and I love it.

You’ve the most impressive websites.

You helped me a lot with this post. I love the subject and I hope you continue to write excellent articles like this.