Updated on 23 May 2025

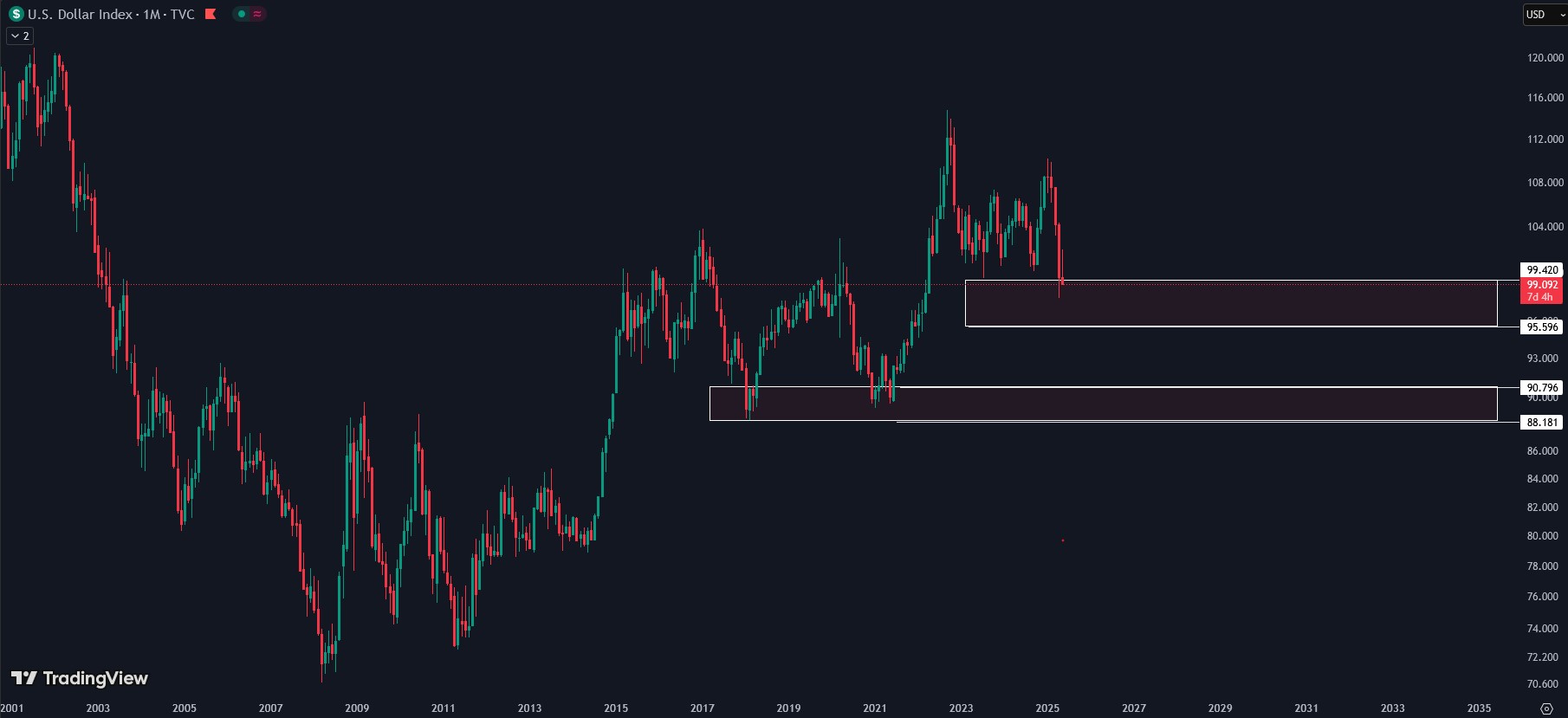

2 New Zones Where the US Dollar Can Bounce Back and Continue Its Upward Movement

Updated on 8 April 2025

Our Mission is Almost Done and The Price Respected to our Expectations!

we are waiting to see US DOLLAR INDEX Bellow 95!

Updated on 24 January 2025

The Dollar Index (DXY) has been a central focus for traders and investors alike, reflecting the strength of the U.S. dollar against a basket of major currencies. Over the next two years, the DXY is likely to experience significant shifts driven by economic, geopolitical, and market forces. In my opinion, the Dollar Index is unlikely to sustain levels above 120. While brief fake breakouts or immediate rejections might occur, the likelihood of such levels holding for an extended period appears minimal.

Instead, a heavy downturn seems to be on the horizon. I foresee the Dollar Index potentially crashing to levels below 95 within the next two years. This decline could be driven by various factors, including an aggressive pivot by the Federal Reserve, weakening U.S. economic fundamentals, or increased global de-dollarization efforts. As inflation stabilizes and global economies diversify their currency reserves, the demand for the dollar could significantly diminish.

Technical indicators also support this bearish outlook. Historical price action shows that 120 has served as a key psychological and structural resistance level. The failure to break above this level in the past hints at strong selling pressure near these highs. On the downside, a drop below 95 would signal a major shift in sentiment, potentially opening the door to further declines.

TradingView Link : Dollar Index for Next 2 years

Frequently Asked Questions

The Dollar Index is anticipated to experience a significant decline, potentially falling below the 95 mark. This projection is influenced by factors such as potential shifts in Federal Reserve policies, weakening U.S. economic fundamentals, and global movements towards de-dollarization.

While brief spikes above 120 might occur, it’s unlikely that the Dollar Index will maintain levels above this threshold for an extended period. Historically, the 120 level has acted as a strong resistance point, suggesting sustained movements above it are improbable.

Historical price actions indicate that the 120 level has consistently served as a psychological and structural resistance. The inability to break above this level in the past suggests strong selling pressure near these highs. Conversely, a drop below 95 would signal a significant shift in market sentiment, potentially leading to further declines.

Several global factors could impact the Dollar Index, including:

Federal Reserve Policies: An aggressive pivot or changes in interest rates.

U.S. Economic Fundamentals: Indicators pointing towards economic weakening.

De-dollarization Efforts: Countries diversifying their currency reserves away from the U.S. dollar.

The U.S. Tariff War

While technical analyses provide valuable insights, traders should remain cautious. Market conditions can change unexpectedly due to macroeconomic factors or unforeseen global events. It’s essential to manage risks appropriately and not rely solely on predictions.

Risk Warning

While technical analysis and predictions provide a valuable framework, trading always carries significant risks. Market conditions can change unexpectedly due to macroeconomic factors or unforeseen global events. It’s crucial to remain cautious and manage your risk appropriately. The Dollar Index’s movements can have widespread implications on forex markets, commodities, and equities, so always consider potential volatility when trading.

These projections should not be taken as financial advice but rather as insights into potential scenarios in the dynamic forex market.