- 👋 Introduction: Starting Strong in Forex Trading

- 🌍 What Is Forex Trading? (Simple Breakdown)

- 🧠 Types of Forex Trading Strategies (Explained Clearly)

- 🔁 How Trading Style and Strategy Work Together

- ✅ Step by Step Guide to Choose the Right Strategy

- 👤 My Unique Insight: The Strategy That Changed My Trading

- 📝 Summary: Which Strategy Should You Choose?

- 🚀 Ready to Take Action?

- ❓ Frequently Asked Questions (FAQ)

👋 Introduction: Starting Strong in Forex Trading

If you’re new to forex trading, the first question that probably comes to mind is: “Where do I even begin?” With so much noise online, it’s easy to feel overwhelmed.

The good news? You’re not alone and you’re in the right place.

I’m Hassan Safari, financial risk manager and CTO at a regulated forex broker. With 7 years of trading and investing experience, I’ve seen beginners struggle, succeed, and everything in between. This guide is here to give you clarity.

We’ll cover:

- What forex trading is (in plain English)

- The main types of forex trading strategies (not just trading styles)

- A step-by-step plan to help you choose and apply one

Let’s dive in.

🌍 What Is Forex Trading? (Simple Breakdown)

Forex stands for foreign exchange. It’s the global marketplace where currencies are bought and sold.

As of 2025, the forex market moves over $7.5 trillion daily, making it the largest and most liquid financial market in the world (BIS, April 2025).

Why Is Forex Trading So Popular?

- Low barrier to entry – start with just $100

- Available 24 hours a day, 5 days a week

- Access to leverage (but use it wisely!)

- Opportunities in both rising and falling markets

⚠️ Leverage can magnify profits but also losses. Always trade with a risk plan.

🧠 Types of Forex Trading Strategies (Explained Clearly)

Unlike trading styles (e.g., scalping or swing trading), a trading strategy is a rule-based method for making trading decisions. It answers: When do I enter and exit a trade?

Here are the most effective forex trading strategies are using in 2025:

1. Trend Following Strategy

Trade in the direction of the prevailing trend.

- How it works: Use moving averages, trendlines, or indicators like ADX to confirm direction.

- Tools: 50 & 200 EMA, price action, trendline breaks

✅ Great for: Beginners who prefer clear, directional markets

⚠️ Avoid during sideways markets

Learn More About : What is a Trend Following Trading Strategy?

2. Range Trading Strategy

Trade between strong support and resistance when the market is moving sideways.

- How it works: Identify price “zones” where the market bounces up and down.

- Tools: Horizontal zones, RSI (for overbought/oversold confirmation)

✅ Great for: Calm markets and structured setups

⚠️ Avoid when price breaks out of the range suddenly

Learn More About : What is Range Trading Strategy? A Complete Guide

3. Breakout Strategy

Enter when price breaks above resistance or below support often after consolidation.

- How it works: Wait for price to build pressure, then break a key level with volume.

- Tools: Chart patterns (triangles, flags), volume spikes

✅ Great for: News events or opening sessions (London/New York)

⚠️ Watch out for false breakouts

Learn More About : What is Breakout Trading Strategy?

4. Retracement (Pullback) Strategy

Enter a trade during a pullback in a trending market.

- How it works: Wait for a temporary dip (or rise) against the trend and enter on a bounce.

- Tools: Fibonacci retracement, moving averages, bullish/bearish candlesticks

✅ Great for: Trend traders looking for better entries

⚠️ Patience is key—don’t enter too early

Learn More About : What Is Retracement (Pullback) Trading Strategy?

5. News-Based Strategy

Trade sharp price movements caused by major economic releases.

- How it works: Track key events (NFP, CPI, interest rate decisions), then trade the volatility.

- Tools: Economic calendar, news feeds, fast execution platform

✅ Great for: High-risk, high-reward setups

⚠️ Spreads widen, slippage is common manage risk tightly

6. Price Action Strategy

Base your trades purely on chart analysis, without relying on indicators.

- How it works: Use candlestick formations (pin bars, engulfing, etc.), structure, and market context.

- Tools: Naked charts, support/resistance, candlestick patterns

✅ Great for: Traders who want clean charts and mastery of behavior

⚠️ Takes time to master but highly rewarding

🔁 How Trading Style and Strategy Work Together

To clarify:

- Trading Style = How long and how often you trade (e.g., scalping, day trading)

- Trading Strategy = The method you use to make trade decisions (e.g., trend following)

🧠 Think of your style as the “when” and your strategy as the “how.”

You can mix and match:

- A day trader using a breakout strategy

- A swing trader using trend following

- A position trader using news-based strategies for macro trends

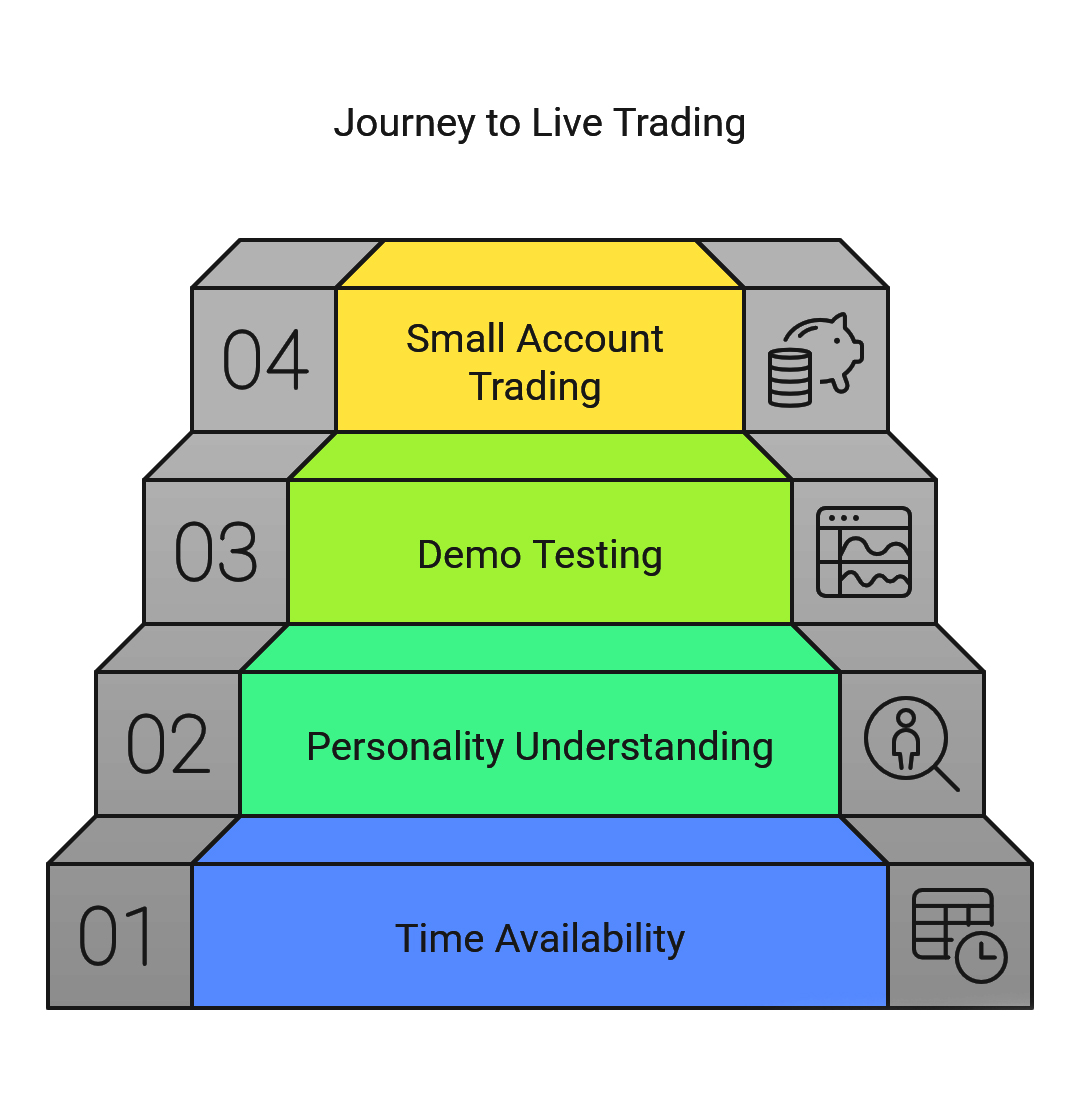

✅ Step by Step Guide to Choose the Right Strategy

Step 1: Know Your Time Availability

| Your Time | Best Styles | Matching Strategies |

|---|---|---|

| Full-Time | Day Trading | Breakout, News-Based |

| Part-Time | Swing | Trend Following, Pullbacks |

| Low-Time | Position | Price Action, Trend/News Combo |

Step 2: Understand Your Personality

- Hate waiting? → Breakouts or News-Based

- Prefer calm, structured moves? → Trend Following or Pullbacks

- Like to analyze? → Price Action or Range Trading

Find Your Trading Style in 5 Minutes : A Quick Quiz

Step 3: Test It on a Demo

Use a demo account to simulate real trades with no risk. Stick to one strategy for 30 days before judging results.

📌 No strategy is perfect. The key is consistency and adaptation.

Step 4: Go Live with a Small Account

Start with $100–$500. Focus on:

- Risk management (1–2% per trade)

- Trading journal (log every trade with reasoning and result)

- Review and refine weekly

👤 My Unique Insight: The Strategy That Changed My Trading

Back in 2018, I started by chasing fast profits through news trades and scalping. I burned my first account fast. When I shifted to trend following and later mixed in price action, everything changed.

That was the foundation for building a strategy that fits me and it worked.

📝 Summary: Which Strategy Should You Choose?

Let’s recap what we covered:

- Forex trading is accessible, global, and full of opportunity but requires strategy.

- A trading strategy is how you make decisions; a style is how often you trade.

- The best beginner strategies in 2025:

- Trend Following

- Breakout

- Pullbacks

- Price Action

- Choose based on your time, personality, and willingness to learn.

🚀 Ready to Take Action?

🎯 Pick one strategy from this list

🧪 Test it on demo for 30 days

📈 Log your trades and progress

📣 Share this guide with a fellow

Stay consistent. Stay patient. The edge is built over time not overnight.

❓ Frequently Asked Questions (FAQ)

There is no “one-size-fits-all” best strategy it depends on your personality, time commitment, and risk tolerance.

That said, trend-following with price action is one of the most beginner-friendly and time-tested strategies. It balances logic with flexibility and helps you stay aligned with market momentum.

Any strategy claiming a 90% win rate is likely misleading or extremely rare. In reality, professional traders win around 50–60% of the time, but they manage risk so well that they remain profitable long term. Focus on consistency, not perfection.

This is a popular structure for new traders:

5 currency pairs to focus on

3 trading strategies to master

1 specific time to trade daily

It keeps you focused, avoids overwhelm, and builds routine essential for developing real skill.

It refers to the harsh reality that 90% of beginner traders lose 90% of their capital in the first 90 days usually due to poor risk management, overtrading, or chasing profits. This rule isn’t a fact it’s a warning. Avoid becoming part of that statistic by using a plan and strict risk control.

No. No strategy wins 100% of the time. Even the most skilled traders experience losses it’s part of the game. What matters is making more on your winners than you lose on your losers.

This is a personal discipline framework some traders use:

3 hours of screen time

5 trades max per day

7 minutes to review each trade

It encourages intentional trading and reduces impulsive behavior perfect for beginners who struggle with overtrading.

Protect your capital. Without money, you can’t trade. That means:

Use stop-losses.

Risk only 1–2% of your balance per trade.

Never revenge trade.

This typically means:

70% of your trades should follow the trend

30% may be counter-trend if justified by strong signals

Following the trend gives you an edge. Going against it should be rare and only when the setup is crystal clear.

That rule applies only to U.S. stock traders under the Pattern Day Trader (PDT) rule.

In forex, there is no $25K minimum, and many brokers allow trading with as little as $100. However, more capital gives you more flexibility and lower risk per trade.

Realistically, you might make 2–5% per month as a beginner so $20 to $50 monthly.

It doesn’t sound like much, but the goal early on is to build consistency, not wealth. Once you’re consistent, capital can scale.

In forex, there’s no limit you can trade as many times as you want.

But more trades don’t mean more profits. Many professionals only take 1–3 high-quality trades per day.

It depends on how you approach it.

Without a plan? It’s gambling.

With a strategy, rules, and risk control? It’s a professional skill.

The key difference is discipline and edge.

Here are 5 timeless ones:

Always use a stop-loss.

Never risk more than 2% per trade.

Trade with the trend.

Keep a trading journal.

Don’t trade what you don’t understand.

These rules have saved thousands of traders including myself more than once.

Yes, but not right away.

You’ll need:

A consistent strategy

Risk management

Emotional control

Adequate capital

Most who succeed spend 6–18 months learning and refining their edge before going full-time. I’ve seen traders make that leap but only after treating trading like a real business.